Overview

Nick Whitney is a partner in Chapman's Banking and Financial Services Department, member of the Commercial Lending Group, and Co-Office Leader of the firm's New York office. Nick has a broad range of experience representing lenders in senior secured, first lien and second lien loan transactions, first-out/last-out financings and unitranche facilities, unsecured transactions and subordinated loan transactions. Nick handles a wide variety of middle-market lending transactions for both non-investment grade and investment grade companies. He represents banks, investment banks, hedge funds, business development corporations and other financial institutions in connection with direct origination, as well as investments in the secondary market and in “club” transactions. He regularly advises lenders in connection with acquisition financings, cash-flow and asset-based transactions and special situations. Nick also has substantial experience with reorganizations and workouts, including representing lenders in connection with debtor-in-possession facilities and Chapter 11 exit facilities.

Representative Matters

Health Care and Life Sciences

- Represented Perceptive Advisors, a life sciences-focused hedge fund, in a $20 million senior debt facility for a biotechnology company pioneering a new class of small-molecule drugs that selectively destroy disease-causing proteins via degredation

- Represented Perceptive Advisors, a life sciences-focused hedge fund, in a $20 million senior debt facility with warrants for Chembio, which designs, develops, tests, and manufactures rapid testing solutions for health care providers around the world

- Represented Perceptive Advisors, a life sciences-focused hedge fund, in a $56 million debt facility with warrants for a company that develops novel and proprietary technologies for diabetes care

- Represented Perceptive Advisors, a life sciences-focused hedge fund, in a senior debt facility with warrants for Icagen, a provider of early drug discovery expertise to pharmaceutical and biotech companies

- Represented a life sciences company in connection with the structuring of a $40 million loan, with an additional accordion facility of up to $20 million and associated warrants, involving a European-headquartered investment firm

- Represented a life sciences company in connection with the structuring of a $17 million equity and debt financing involving a consortium of institutional and high net worth investors

- Represented a hedge fund in connection with a $15 million loan to a molecular diagnostics company

- Represented a hedge fund in connection with a $10 million loan to a biopharmaceutical company

- Represented a hedge fund in connection with a $30 million loan to a medical device company

- Represented a hedge fund in connection with a $42.5 million loan to a medical device company

- Represented a hedge fund in connection with a financing for a cancer treatment development company

Technology and Media

- Represented a hedge fund in connection with a $16 million senior secured term loan to a technology products and services company

- Represented hedge fund in connection with a $15 million loan made to a digital gaming company

- Represented hedge fund in connection with a $45 million loan made to equipment power company

- Represented a business development company in connection with an approximately $200 million unitranche financing provided to a software company

- Represented a lender in connection with a $35 million mezzanine loan made to a wireless cell tower operator

- Represented hedge fund in connection with a $95 million first lien, second lien and third lien loan to a media company

- Represented a business development company in connection with a $72 million facility to a data analysis company

Energy and Resources

- Represented a hedge fund in connection with a $45 million loan to a power company

- Represented a business development company in connection with a second lien incremental loan made to an energy company

- Represented a prominent hedge fund in connection with a $450 million syndicated term loan provided to an iron ore mining company

- Represented a hedge fund in connection with a $37.5 million Senior Secured term loan to a coal mining company

Real Estate

- Represented a specialty lending desk in connection with a $56 million loan to fund the development of a condominium tower

- Represented a hedge fund in connection with a $14 million mezzanine loan to an apartment complex development

Other Commercial Loans

- Represented Clairvest Group Inc., Clairvest Equity Partners VI, and Rubico Gaming LLC in a financing of the Delaware Park casino and racetrack in Wilmington, Delaware

- Represented a specialty lender in a $20 million senior secured term loan for a life settlement policy investor

- Represented a non-bank lender in connection with a term loan and delayed draw facility for a restaurant franchise with restaurants across nine states

- Represented a business development company in connection with an approximately $200 million unitranche financing provided to a software company

- Represented a business development company in connection with a $25 million revolving credit to a customer experience management company

- Represented a business development company in connection with a $350 million unitranche financing to a company in the year books and graduation products industry

- Represented a business development company in connection with a $107 million unitranche facility

Practice Focus

Memberships

American Bankruptcy Institute

American Bar Association

Association of Commercial Finance Attorneys

Loan Syndications and Trading Association (LSTA)

Secured Finance Network

Admitted

New York

Education

New York Law School, J.D., 1998

Seton Hall University, B.S., 1995

Notable Engagements

- Debt Facility for Biopharmaceutical Company

Chapman served as counsel to a health care and life sciences hedge fund in a $10 million debt facility for a biopharmaceutical company. The debt facility will be used to repay an existing debt facility and support the company's build out of its manufacturing facility.

- Term Loan for a Molecular Diagnostics Company

Chapman served as counsel to a life sciences hedge fund in connection with a $15 million term loan facility for a molecular diagnostics company. The term loan facility includes an initial $15 million tranche and a second $10 million tranche that is available at the company’s option over the next year.

- Acquisition of High-Precision Metal Components Supplier

Chapman represented Turnspire Capital Partners LLC, a special situations-focused private investment firm, in its acquisition of the assets of MPI Holdings, LLC, a leading supplier of formed metal products to the North America automotive industry.

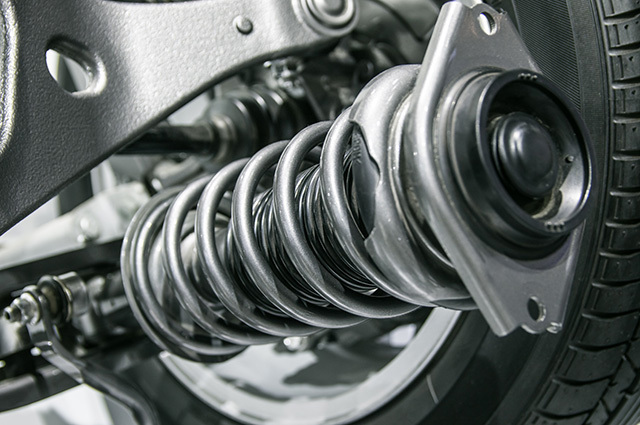

- Acquisition of Commercial Vehicle Suspension Component Supplier

Chapman represented Turnspire Capital Partners LLC, a special situations-focused private investment firm, in its acquisition of Infinity Engineered Products, a leading provider of premium air springs for trucks, trailers, buses, and specialty vehicles.

- Acquisition and Financing of Delaware Park Casino and Racetrack

Chapman served as lead counsel to Clairvest Group Inc., Clairvest Equity Partners VI, and Rubico Gaming LLC in the acquisition and financing of the Delaware Park casino and racetrack in Wilmington, Delaware.

- Acquisition of Measurement and Control Business of Emerson Electric

Chapman represented Turnspire Capital Partners LLC, a special situations-focused private investment firm, in its acquisition of Daniel Measurement and Control, a global leader in providing measurement technologies and services for the energy industry, from Emerson Electric Co.

- Acquisition Financing of Cleanroom Companies

Chapman represented private equity firm ASGARD Partners & Co. and its portfolio company, Angstrom Technology, in connection with the financing of Angstrom's acquisition of two UK-based cleanroom design and production companies, Connect 2 Cleanrooms Limited and Specific Environments Limited. The acquisitions bolster strategic investments in life sciences, cell and gene therapy, biotech, and pharmaceutical end markets.

- Financing 5G in Canada

Counsel to the investment company in a $20 million secured debt facility for a Canadian fixed wireless access and private network service provider.

- Data-Driven Diagnostics Company Loan Facility

Counsel to Perceptive Advisors, a life sciences-focused hedge fund, in a term loan facility for a data-driven diagnostics solutions company focused on lung disease.

- Financing Dental Practices

Counsel to the investment company in a $20 million credit facility for a dental practice operator.

- Genetics Company Loan Facility

Counsel to Perceptive Advisors, a life sciences-focused hedge fund, in a term loan facility for a genetic testing and sequencing company.

Insights

Publications

- Co-Author, "Pro Rata Sharing Provisions in Credit Agreements: What Lenders and Loan Investors Need to Know," Pratt's Journal of Bankruptcy Law. October 2017.

- Co-Author, "Companies Are Using Covenants to Restructure Their Capital Structure and Prime Existing Debt — What Lenders and Debt Investors Need to Know," Harvard Law School Bankruptcy Roundtable. March 14, 2017.

- Co-Author, "Companies Are Using Covenants to Restructure Their Capital Structure and Prime Existing Debt — What Lenders and Debt Investors Need to Know," ACIC Private Notes. March 2017.

- Co-Author, "What You Need to Know about 'Unrestricted Subsidiaries'," Law360. February 14, 2017.

- Co-Author, "Leveraged Lending Guidelines, New Debt Structures and Pitfalls in Bankruptcy," AIRA Journal. Vol. 30 No. 2, 2016.

- Co-Author, "Unitranche Facilities and the Jurisdiction of Bankruptcy Courts: RadioShack's Chapter 11 Leaves Questions Unanswered," Client Alert. August 13, 2015.

- Co-Author, "Vote More Than Once? Numerosity and Possible Reform," Law360. July 24, 2015.

- Co-Author, "Change of Control Defaults: Healthways Case May Put Lenders' Protections in Doubt," Client Alert. June 16, 2015.

- Author, "Unitranche Facilities and Agreements Among Lenders," Lexis Practice Advisor. May 16, 2014.

- Co-Author, "Strategies and Limitations of Sponsor Buybacks," American Bankruptcy Institute Journal. January 2014.

- Co-Author, “The Unitranche Facility: Implications,” American Bankruptcy Institute Journal.

- “The Latest Innovation in Middle-Market Lending,” Law360.

- “Unitranche Facility & Middle Market Lending,” peHUB.

- "The Latest Innovation in Middle Market Lending: The Unitranche Facility"

- Co-Author, "Unanimous Lender Consent Provisions: Protection?," Law360

- Co-Author, "Unanimous Lender Consent Provisions May Not Provide the Protection Expected"

- "UPDATE: Using Incremental Facilities to Exchange Bond Indebtedness - The Realogy Decision"

- "Using Incremental Facilities to Exchange Bond Indebtedness"

- Lending, Investing and Trading After the Market Break

- "The Defaulting Lender in Today's Loan Market"

- "Purchases of Bank Loans by a Borrower or its Sponsor"

- "Incremental Loan Facilities: Key Provisions"

Presentations

- 7th Annual Midwest Bank Special Assets & Credit Officer's Forum

- The 3rd Global Distressed Debt Investor Forum

- Distressed & Turnaround Investment Conference