On April 26, 2016, the Federal Deposit Insurance Corporation ("FDIC") issued a proposed rule to implement the Net Stable Funding Ratio ("NSFR") requirement. Thomas J. Curry from the Office of the Comptroller of the Currency ("OCC") was present at the FDIC's board meeting and signed the proposed rule on behalf of the OCC. The Board of Governors of the Federal Reserve Board will consider the proposed NSFR rule at its meeting on May 3, 2016.

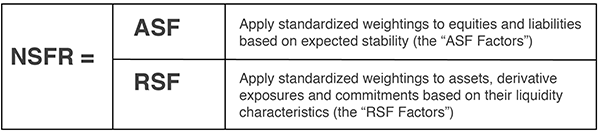

The NSFR will require covered banking organizations to maintain stable funding profiles in relation to their on- and off-balance sheet activities (including unfunded credit and liquidity commitments in securitization transactions). The NSFR is designed to reduce funding risk over a longer term horizon by requiring banking organizations to fund their activities with sufficiently stable sources of funding in order to mitigate the risk of future funding stress.

The Basel Committee on Banking Supervision ("BCBS") issued its final NSFR guidelines in October of 2014. The proposed rule is generally consistent with with the final Basel guidelines in all respects relevant to securitization transactions, except that, consistent with the U.S. Liquidity Coverage Ratio, private label MBS does not qualify as a level 2B liquid asset and therefore for a lower required stable funding amount.

The NSFR would apply to all U.S. bank and savings and loan holding companies with consolidated assets of $250 billion or more or $10 billion or more of on-balance sheet foreign exposures. The proposed rule also contains a modified version of the NSFR that would apply to U.S. bank and savings and loan holding companies with consolidated assets of $50 billion or more and less than $10 billion of on-balance sheet foreign exposures. The modified NSFR would require available stable funding that at least equals 70% of a banking organization’s required stable funding amount.

The NSFR and modified NSFR would be effective on January 1, 2018.

The draft of the proposed rule currently available indicates comments are due by August 5, 2016. An April 26, 2016 memorandum from the FDIC's Division of Risk Management Supervision to the Board of Directors indicates that the comment period would end on July 29, 2016. A copy of the proposed rule can be found here.