Client Alert

On July 27, 2023, the three federal banking agencies1 jointly issued a “notice of proposed rulemaking” captioned “Regulatory Capital Rule: Large Banking Organizations and Banking Organizations With Significant Trading Activity”2 (NPR) that is more commonly described as “the Basel III endgame.”3 The US Basel III rule amendments proposed in the NPR would change how large banks report their risk-weighted assets (RWAs) and, for Category III and IV banks, how they would report both their capital and their minimum capital requirement compliance under the rule.

The NPR, as published in the Federal Register, is available here. In endnotes to this Client Alert, we refer to pages of that Federal Register version of the NPR for various features of the NPR.

Background to the NPR

When the agencies enacted the US Basel III rule in 2013, they required banks with $250 billion or more in assets to compute RWAs under both the Standardized Approach and the Advanced Approaches, with the larger of the two RWA computations being the RWAs used to determine compliance with minimum capital requirements.

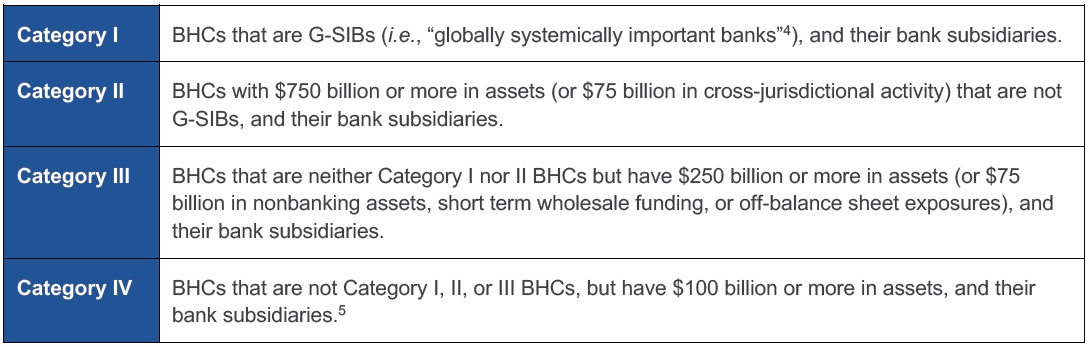

In 2019, consistent with 2018 legislation calling for greater “tailoring” of bank prudential standards, the agencies increased that threshold to $750 billion as part of establishing four categories of bank holding companies (BHCs) with $100 billion or more in assets. The four categories are:

Currently, US banks report RWAs under three separate approaches:

- The Standardized Approach (Subpart D of the US Basel III rule), which applies to all BHCs and banks (other than small community banks that continue to report RWAs only under the US Basel I rule and other community banks that have qualified for a program established in 2019 to limit capital requirements for certain community banks to a simple leverage ratio).

- The Advanced Approaches (Subpart E of the US Basel III rule), which apply only to Category I and II BHCs and their subsidiary banks.

- The Market Risk rule (Subpart F of the US Basel III rule), which applies to BHCs and banks with significant trading assets.

The Proposed Rule Amendments in the NPR

The proposed amendments to the US Basel III rule contained in the NPR would change both how RWAs are reported and the range of BHCs and banks required to report RWAs under approaches other than the Standardized Approach. The proposed amendments would also generally require Category III and IV BHCs and banks to comply with capital, including capital computation, requirements that currently only apply to Category I and II BHCs and their subsidiary banks.

What would the proposed amendments do to the US Basel III rule?

- Replace the existing US Basel III risk-based capital rule “Subpart E—Risk-Weighted Assets—Internal Ratings-Based and Advanced Measurement” approach (Advanced Approaches) with a new “Subpart E—Risk-Weighted Assets—Expanded Risk-Based Approach” (ERB Approach).

- Replace the existing US Basel III risk-based capital rule “Subpart F—Risk-weighted Assets—Market Risk” with a new “Subpart F—Risk-Weighted Assets—Market Risk and Credit Valuation Adjustment (CVA)”

- Add definitions to the rule, or revise existing definitions in the rule, to accommodate the new ERB Approach, the elimination of the Advanced Approaches, and the new market risk rule, while also “correcting” or “clarifying” some existing definitions.6

How would the proposed Subpart E change existing US Basel III rule requirements?

The proposed new Subpart E would mean:

- The Advanced Approaches would be eliminated. No BHC or bank would report RWAs under the Advanced Approaches. Currently, Category I-II BHCs and their subsidiary banks are required to report Advanced Approaches RWAs.

- All Category I-IV BHCs and their subsidiary banks would be required to:

- report credit risk RWAs under the completely new ERB Approach, as well as under the Standardized Approach.

- compute “operational risk” RWAs under a new operational risk framework in the new Subpart E. Currently only Category I and II BHCs and their subsidiaries compute operational risk RWAs as part of the Advanced Approaches, and that method for computing operational risk RWAs differs significantly from the proposed new approach.

- include in “Common Equity Tier I (CET 1) capital” elements of “accumulated other comprehensive income” (AOCI) that all other BHCs and banks can elect to exclude.7

- comply with the original US Basel III rule for (i) limiting the recognition of minority interests, and (ii) deducting mortgage servicing assets (MSAs), certain deferred tax assets (DTAs), and investments in the capital of unconsolidated financial institutions, which requirements had been eased through the 2019 “simplifications to the capital rules” (2019 Capital Simplification) for all BHCs and banks other than Category I-II BHCs and their subsidiary banks.

- comply with the “supplementary leverage ratio” (SLR) requirement and, if deployed by the agencies, the “countercyclical capital buffer” (CCyB) requirement, both of which currently only apply to Category I-III BHCs and their subsidiary banks.8

- compute counterparty credit risk for OTC derivatives using the “standardized approach” (SA-CCR), which is currently mandatory only for Category I-II BHCs and their subsidiary banks.9

Currently, only Category I and II BHCs and their subsidiary banks are (1) required to report credit risk RWAs under both the Standardized Approach and the Advanced Approaches and (2) denied the option to exclude certain AOCI from CET 1 capital.

Currently, Category III and IV BHCs and banks are only required to report credit risk RWAs under the Standardized Approach, do not compute operational risk RWAs, and had the one-time option to exclude certain AOCI from CET 1 capital.

How would the proposed new Subpart E ERB Approach methodology for computing RWAs differ from the existing Subpart E Advanced Approaches?

Completely. The proposed ERB Approach is based upon the “standardized approach” contained in the updated “Basel Framework” finalized in 2017. That standardized approach retains the basic features of the original 1988 “Basel Accord” that assigned risk weights to various categories of counterparties and “credit conversion factors” to “off-balance sheet exposures” so that both on-balance sheet exposures (at par) and of-balance sheet exposures (based on their CCFs) could be “risk weighted” to produce “risk weighted assets.” The proposed ERB approach would be a new version of this basic approach, different from the Subpart D Standardized Approach (which would remain in effect) by providing different risk weights for some exposures (including some newly identified types of exposures) and different CCFs for some off-balance sheet exposures.

Under the proposed new Subpart E, the Advanced Approaches and their basis in “internal bank models” would be completely eliminated. No element of that approach would remain in Subpart E.

Instead, the agencies will provide risk weights under two different versions of structurally similar “standardized approaches,” the continuing Subpart D Standardized Approach used by all US banks subject to risk-based capital standards, and the new Subpart E updated “standardized approach,” to be known as the ERB Approach, to be used as an alternative method by all Category I-IV banks, which will be the relevant measure for capital compliance, if it produces larger RWAs than the Standardized Approach, as expected.

We will issue a separate Client Alert describing how the proposed ERB Approach differs from the existing Standardized Approach in assigning risk weights and CCFs to various exposures.

In addition, the operational risk provisions in the proposed ERB Approach would be based on a ‘standardized approach” that is very different from the existing “advanced measurement approach” (AMA) that is currently part of the Advanced Approaches. As operational risk RWAs are currently part of total Advanced Approaches RWAs, operational risk RWAs computed under the ERB Approach in the proposed new Subpart E would be part of “Expanded Total” RWAs, if the proposal were adopted.

What BHCs and banks would be required to report RWAs under the proposed new Subpart E?

The proposed new Subpart E ERB Approach would apply to all Category I-IV BHCs and their bank subsidiaries. In general, that means all BHCs with $100 billion or more in assets and their bank subsidiaries would be required to compute ERB Approach RWAs under the proposed rule.

The current Subpart E Advanced Approaches apply only to Category I and II BHCs and their bank subsidiaries. In general, that means only BHCs with $750 billion or more in assets and their bank subsidiaries are currently required to compute AA RWAs.

As noted above, because the proposed new Subpart E includes procedures for computing operational risk RWAs, Category III and IV BHCs and banks would become subject to that requirement. Currently, under the Subpart E Advanced Approaches, only Category I and II BHCs and banks are required to compute RWAs for operational risk.

How would the proposed Subpart F change existing US Basel III rule requirements?

As the title of the proposed new Subpart F implies, it would contain both a new market risk rule and a CVA requirement for BHCs and banks that meet specified requirements. Currently, only BHCs and banks required to compute RWAs under the existing Subpart E Advanced Approaches are required to compute RWAs for CVA risk.

How would the proposed Subpart F change the existing methodology for computing market risk RWAs?

The proposed new Subpart F would permit market risk RWAs to be computed using a “standardized measure” or a “model-based measure” for market risk, subject to severe restrictions on the scope and use of internal “models.”10 The existing Subpart F market risk rule provides for computing market risk RWAs based on “value at risk” (VAR) methodology.11 The proposed Subpart F would replace VAR methodology with “expected shortfall” methodology either in the “model-based measure” or through specified risk weights in the “standardized measure” that reflect expected shortfall methodology.

The proposed Subpart F would limit the use of a “model-based measure” approach to approved “trading desks” at a BHC or bank, rather than permitting the overall BHC or bank to use such approach.12 It would also constrain the role of “internal models” by specifying parameters for such models.

Because of the “output floor” described next, BHCs and banks using the “model-based measure” for any market risk RWAs would need to compute separately the “standardized measure” for the exposures giving rise to those market risk RWAs in order to compute compliance with the output floor.

What is the proposed new “output floor” that would limit how much market risk RWAs computed under

the proposed Subpart F using the “model-based measure” could differ from the RWAs that would be computed for the same exposures under the “standardized measure” for computing market risk RWAs proposed in the NPR?

The proposal would limit how large the difference could be between a BHC’s or bank’s market risk RWAs computed under the model-based and standardized method by requiring all BHCs and banks applying the market risk rule to compute standardized measures for all exposures that give rise to a “model-based measure” of RWAs. The aggregate amount of the “standardized measure” RWAs for all market risk exposures would then be added to all other components of the BHC’s or bank’s “Expanded Total” RWAs to determine whether the “Expanded Total” RWAs computed including “model-based” market RWAs would equal or exceeds 72.5% of the “Expanded Total” RWAs computed using solely the “standardized measure” for computing market risk RWAs. If not, the “output floor” would require the BHC or bank to report as the market risk component of its “Expanded Total” RWAs the 72.5% floor amount.

As a practical matter, the proposed “output floor” should only limit the “benefits” of the “model-based” measure for BHCs or banks that hold very large percentages of their total assets in assets that would be subject to the market risk rule. This is because the “output floor” is 72.5% of the total amount of RWAs computed for “credit risk-weighted assets, equity risk-weighted assets, operational risk-weighted assets, and CVA risk-weighted assets under the expanded risk-based approach and risk-weighted assets calculated using the standardized measure for market risk, minus any amount of the banking organization’s adjusted allowance for credit losses that is not included in tier 2 capital and any amount of allocated transfer risk reserves.”

This means the only difference between the “output floor” computation and the basic (or “initial”) computation of ERB Approach RWAs would be the “model-based” RWAs computed by approved trading desks of the BHC or bank for exposures that would have RWAs computed using the “standardized method” for purposes of computing the output floor. The floor would only matter if the difference between market risk RWAs computed using the model-based rather than standardized approach produced RWAs smaller than the standardized approach market risk RWAs by an amount equal to more than 27.5% of the bank’s overall total RWAs.

How would the proposed Subpart F change the existing methodology for computing CVA risk RWAs?

CVA risk is the risk that counterparties on derivatives contracts that are not “cleared transactions” will experience credit deterioration that requires accounting charges to reflect the risk that such counterparties will not meet their obligations to the BHC or bank to which they may owe payment obligations. To establish a capital “reserve’ for this risk, the existing Subpart E requires Advanced Approaches (i.e., Category I-II) BHCs and banks to compute CVA risk RWAs using either a “simple” or “advanced approaches” methodology.

The proposed new Subpart F would extend to all Category I-IV BHCs and banks the requirement to compute CVA RWAs. It would replace the existing methodologies for computing such RWAs with a “basic” and “standardized” approach. To use the new “standardized” rather than “basic” approach, a BHC would need to receive Federal Reserve approval and a bank would need to receive approval from the agency that is its primary federal regulator.13

What BHCs and banks would be required to report RWAs under the proposed new Subparts F?

The proposed new Subpart F has separate standards for applying the market risk and CVA requirements.

As with the current Subpart F market risk rule, all BHCs and banks with trading activity equal to more than 10% of their assets would be required to compute market risk RWAs. The existing separate requirement for any BHC or bank with $1 billion or more of trading activity would be increased to $5 billion.

In addition, the proposed new Subpart F would require all Category I-IV BHCs and banks to compute market risk RWAs regardless of their level of trading activity. The existing rule has no such separate requirement.

The proposed Subpart F would also require all Category I-IV BHCs and banks to compute CVA RWAs regardless of their level of CVA exposure. The existing Subpart E requirement to compute CVA RWAs only applies to Category I-II BHCs and banks, because they are the only BHCs, or banks required to compute Advanced Approaches RWAs. The proposed rule would permit the agencies to require any other BHC or bank to compute CVA RWAs, if the Federal Reserve (for BHCs) or the agency that is the primary federal supervisor of the bank determines that is appropriate because of the BHC’s or bank’s level of CVA risk or otherwise.

What new capital ratio requirements would apply to Category IV BHCs and banks under the proposal?

Currently, only Category I-III BHCs and banks are required to comply with “countercyclical capital buffer” (CCyB) requirements, if such requirements are deployed by the agencies (which has not happened), and the “supplementary leverage ratio” (SLR). Under the proposal, the CCyB and SLR requirements would extend to Category IV BHCs and banks.

What are the “capital buffer” changes the NPR proposes for Category I-IV BHCs and banks?

The proposal would apply to all Category I-IV BHCs and banks the same “stress capital buffer” (SCB) requirements, revised for the ERB Approach. As discussed above, Category IV BHCs would be subjected to the CCyB, if deployed, that is currently only applicable to Category I-III BHCs.

Currently, all such BHCs and banks are subject to a “standardized approach capital conservation buffer,” which includes a “stress capital buffer” (SCB), requirement as part of the “capital plan rule” annual stress tests. Currently, only Category I and II BHCs and banks are subject to the separate 2.5% capital buffer requirement that replaces the SCB for purposes of computing the “advanced approaches capital conservation buffer.” This is because BHCs and banks are not required to project capital ratios using the Advanced Approaches.

Because the proposal would eliminate the Advanced Approaches and adopt in replacement the ERB Approach, which is essentially a modified form of the Standardized Approach, the agencies propose to include the SCB for the “binding CET 1 capital ratio” (i.e., the ratio resulting from the higher of the RWAs computed under the Standardized and ERB Approaches). As described above, this will almost certainly be the RWAs produced by the ERB Approach. This avoids requiring banks and BHCs projecting ratios under both approaches.14

Does the application of so many new requirements on Category III and IV BHCs and banks mean the “tailoring” of enhanced prudential standards” established in 2019 would be rescinded for risk-based capital purposes by the proposed new rule?

Yes, in the sense that Category III and IV BHCs and banks would be subjected to the same standards as Category I and II BHCs and banks after Category III BHCs and banks had been relieved of those common standards through the 2019 standards.

In addition, any such banks that currently do not report market risk RWAs because of low levels of trading assets (which is unlikely) would be required to report market risk RWAs regardless of the level of their trading assets. Those already reporting market risk RWAs would be required to use the proposed new method, which is expected to increase reported market risk RWAs significantly.

Is this consistent with the 2018 legislation that directed the agencies to “tailor” bank capital requirements?

In adopting the proposed rules, three members of the Federal Reserve Board addressed this question. Two suggested the proposed amendments were inconsistent with the 2018 legislation.15 In explaining his vote for releasing the proposal, Board Chair Powell explained that, in his view, “events in the last twelve months” have “demonstrated the need for greater capital levels at banks with $100-250 billion in assets.”16 This is presumably an answer to Governor Bowman’s concern that applying larger capital requirements to such banks is inconsistent with the 2018 legislation. Similarly, in the NPR the agencies state that, although in 2019 the agencies had eliminated the requirement for Category III BHCs and banks to compute Advanced Approaches RWAs, “recent events” support “further alignment of the regulatory capital framework across large banking organizations.”17

As at the Federal Reserve Board, at the FDIC two board members questioned whether the proposal is consistent with the 2018 legislation.18

How much would the proposed new Subpart E and F increase required bank capital levels for those banks required to compute RWAs under the proposed new Subparts?

As noted above, the amendments proposed in the NPR would require all Category I-IV BHCs and banks to compute RWAs under both proposed new subparts.

The agencies estimate that the RWAs computed under those two subparts by Category I and II banks will significantly exceed the RWAs they compute under the existing Subpart D Standardized Approach and Subpart F Market Risk standards. Currently, most (or all) Category I and II BHCs and banks report more RWAs under the Subpart D Standardized Approach and Subpart F Market Risk requirements than they do under the combination of their Subpart E Advanced Approaches RWAs and Subpart F market risk RWAs. This means Category I and II BHCs and banks currently have their “effective” minimum required capital levels determined by their Standardized Approach RWAs, not their Advanced Approaches RWAs, despite the fact that currently operational risk and CVA RWAs are computed only under the Advanced Approaches.

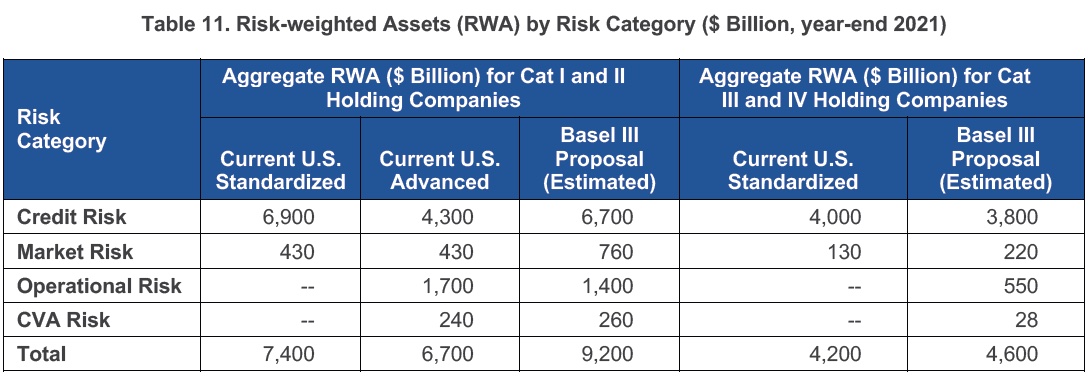

The agencies estimate this will change dramatically if the proposal is enacted, as shown in this Table 11 reproduced from page 64168 of the September 18, 2023, Federal Register:

Table 11 shows that, although Operational Risk and CVA Risk are only computed under the Advanced Approach, BHCs reporting under the Advanced Approaches, in aggregate, report roughly 10% lower RWAs under the Advanced Approaches than the Standardized Approach. Under the proposal, however, such BHCs, in aggregate, would report roughly 80% as many RWAs under the Standardized Approach as under the proposed Subparts E and F, because of higher credit risk RWAs under the proposed Subpart E ERB Approach and larger market risk RWAs for market risk under the proposed Subpart F, along with slightly larger CVA Risk RWAs under the proposed Subpart F compared to the existing Subpart E AA.

The last two columns in Table 11 suggest the increase in minimum capital requirements will be less for Category III and IV banks, as they are estimated to experience less than a 10% increase in RWAs compared to their existing Standardized Approach RWAs for the same exposures that were reported on their year-end 2021 balance sheets.

When might these proposed changes start applying to BHCs and banks?

The agencies will not adopt a final rule before receiving comments on the NPR and responding to those comments in any final rule release. Comments were original due by November 30, 2023, but on October 20, 2023, the agencies extended the comment period to January 16, 2024.19 Comments already filed with the agencies have requested the agencies collect further data to estimate the effects of the rules proposed in the NPR.20

The NPR proposed a three-year transition period beginning in 2025 for gradually implementing the AOCI adjustment and “expanded total risk-weighted assets” computations contained in the proposal.21 The start and end dates for any such transition would, of course, be adjusted if the proposal rule were not adopted as final until later than the agencies originally anticipated.

- The Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System, and the Federal Deposit Insurance Corporation (FDIC).

- https://www.federalregister.gov/documents/2023/09/18/2023-19200/regulatory-capital-rule-large-banking-organizations-and-banking-organizations-with-significant (NPR)

- https://www.federalreserve.gov/newsevents/pressreleases/bcreg20230727a.htm (“The changes would implement the final components of the Basel III agreement, also known as the Basel III endgame.”)

- These are the six largest US BHCs (Bank of America, Citigroup, Goldman Sachs, JP Morgan Chase, Morgan Stanley, and Wells Fargo).

- For more on the BHC Categories see “Federal Banking Regulators Propose New Bank Holding Company Category System to Apply to Capital and Liquidity Requirements and to Enhanced Prudential Standards.”

- See page 64172 for the agencies’ description of corrections and clarifications to the definitions of “qualifying master netting agreement” and “total leverage exposure,” for examples.

- NPR at page 64036 (“Under the proposal, consistent with the treatment applicable to banking organizations subject to Category I or II capital standards, banking organizations subject to Category III or IV capital standards would be required to include all AOCI components in common equity tier 1 capital, except gains and losses on cashflow hedges where the hedged item is not recognized on a banking organization’s balance sheet at fair value. This would require all net unrealized holding gains and losses on available-for-sale (AFS) debt securities 30 from changes in fair value to flow through to common equity tier 1 capital, including those that result primarily from fluctuations in benchmark interest rates. This treatment would better reflect the point in time loss-absorbing capacity of banking organizations subject to Category III or IV capital standards and would align with banking organizations subject to Category I or II capital standards.”)

- Sec 10(c) of the US Basel III rule currently applies SLR to Advanced Approaches plus Category III BHCs and banks. Section 11(b) does the same for the CCyB.

- For the significance of this change, see NPR page 64171 (“Third, the proposed elimination of the internal models method for calculating derivatives exposures would require all large banking organizations to use the standardized approach for counterparty credit risk to calculate their single-counterparty credit limits. The agencies estimate that the standardized approach for counterparty credit risk would generally result in higher derivative exposures than the internal models method. Therefore, credit limits for counterparties to which a banking organization has derivatives exposure are likely to become more stringent under the proposal.”)

- For a fuller explanation, see NPR starting on page 64102 under heading “5. General Requirements for Market Risk.”

- See NPR page 64091 (beginning with “H. Market Risk”) and succeeding pages of the NPR’s Market Risk description (Section H of the NPR’s “Supplementary Information” Part II).

- See NPR pages 64092-95 under “b. Overview of the Proposal” for a fuller description.

- See NPR pages 64150 (starting under “I Credit Valuation Adjustment Risk”)-64159.

- For more details, including timings for computations, see NPR pages 64034-35 under “2. Stress Capital Buffer Requirement.”

- Most directly, Board Governor Bowman stated “Today's proposal represents a reversal of this longstanding approach. In my view, the proposal fails to sufficiently take into account differences in capital structure, riskiness, complexity, financial activities, size, and other risk-related factors among firms with more than $100 billion in assets, and instead reverts to a one-size-fits-all approach. Although it is currently unclear and unsettled what other changes may be proposed to the regulatory capital framework, or more broadly to other prudential regulations, I am concerned that pushing down capital and other standards designed for larger banks to those that are significantly smaller and less complex could lead to harmful, unintended consequences. I am also concerned that today's proposal moves one step closer to eliminating the tailoring required by S. 2155 from the prudential capital framework.” https://www.federalreserve.gov/newsevents/pressreleases/bowman-statement-20230727.htm. Governor Waller stated: “as this proposal applies to all firms with more than $100 billion in assets, I am concerned that we are headed down a road where we would be no longer in compliance with section 165 of the Dodd-Frank Act, as amended by the Economic Growth, Regulatory Relief, and Consumer Protection Act, which mandates tailoring for firms above $100 billion in assets and provides that firms with between $100 billion and $250 billion in assets are not subject to enhanced prudential standards unless a standard is affirmatively applied to such firms based on specific factors set out by Congress. It is unclear to me whether this proposal meets that statutory bar.” https://www.federalreserve.gov/newsevents/pressreleases/waller-statement-20230727.htm.

- https://www.federalreserve.gov/newsevents/pressreleases/powell-statement-20230727.htm.

- Page 64032 of NPR (“Previously, the agencies determined that the advanced approaches requirements should not apply to banking organizations subject to Category III or IV capital standards, as the agencies considered such requirements to be overly complex and burdensome relative to the safety and soundness benefits that they would provide for these banking organizations.20 The expanded risk-based approach generally is based on standardized requirements, which would be less complex and costly. In addition, recent events demonstrate the impact banking organizations subject to Category III or IV capital standards can have on financial stability. While the recent failure of banking organizations subject to Category IV capital standards may be attributed to a variety of factors, the effect of these failures on financial stability supports further alignment of the regulatory capital framework across large banking organizations.”)

- Vice Chair Travis Hill stated: “In 2018, Congress passed S. 2155, which, among other things, (1) raised the threshold for which firms were subject to enhanced prudential standards (EPS) from $50 billion to $250 billion in assets, while authorizing the Federal Reserve to apply enhanced standards to firms between $100 billion and $250 billion in assets, and (2) mandated that regulators tailor application of EPS for firms in scope. In 2019, the Federal Reserve, in part with the Office of the Comptroller of the Currency (OCC) and the FDIC, issued the tailoring rules, which implemented both of these mandates by establishing quantitative metrics for the application of standards to large banks. Categories I, II, and III included all firms with $250 billion or more in assets, plus other institutions that met specific criteria, while Category IV included the remainder of institutions with $100 billion or more in assets, who were in effect generally excluded from EPS. Today’s proposal repudiates these concepts, by “aligning” the capital rules for all banks with $100 billion or more in assets. This “alignment” includes application of the supplementary leverage ratio, the countercyclical capital buffer, and the standardized approach for counterparty credit risk, and the treatment of TLAC holdings, mortgage servicing rights, certain deferred tax assets, non-significant investments in the capital of unconsolidated financial institutions, minority interests in subsidiaries of banking organizations, and all other comprehensive income (AOCI). None of that is at all related to the new Basel agreement. In addition, the proposal would further apply the full scope of the new Basel standard to all institutions with $100 billion or more in assets. This includes applying the entire market risk framework to regional banks with de minimis trading activities, who have never previously calculated market risk capital, and who will now need to build out market risk compliance operations and systems despite market risk having virtually no impact on the institutions’ actual capital levels.

For purposes of the capital rules, the proposal effectively collapses Categories II, III, and IV into one category. The proposal undoes almost all of the tailoring of the capital framework for large banks and is a repudiation of the intent and spirit of S. 2155. It is further a troubling sign for future policymaking, a signal that regulators intend to treat all large banks alike, in defiance of Congressional directives and in contradiction to the objective of a diverse banking sector with banks of varying sizes, niches, and business models.

Of course, I recognize that three Category IV banks failed earlier this year, at a substantial cost to the Deposit Insurance Fund, and, in one case, in quite spectacular fashion. I think there are lessons for us to consider from these failures around topics like interest rate risk, deposit insurance, contingency funding, and large bank resolution. But I also think it’s important that our reactions be thoughtful and targeted, and that we avoid the temptation to overregulate all Category IV banks in response to the unique circumstances of the spring failures. It’s worth noting that implementation of the new Basel agreement was expected to result in no increase in required capital at any of the three banks that failed but would result in major increases at several other Category IV banks.” https://www.fdic.gov/news/speeches/2023/spjul2723b.html

Board Member Jonathan McKernan raised under “general issues”: “Question 2. Agency authorities. What requirements or restrictions on each agency’s authorities are implicated by the proposal? Does the proposal tailor or otherwise differentiate among banking organizations to the extent required by law?” https://www.fdic.gov/news/speeches/2023/spjul2723c.html - https://www.federalreserve.gov/newsevents/pressreleases/bcreg20231020a.htm

- https://www.federalreserve.gov/SECRS/2023/November/20231101/R-1813/R-1813_101323_154734_486154207979_1.pdf

- See NPR page 64166 (Table 9 for “Expanded Total Risk-Weighted Assets and Table 10 for AOCI).