Client Alert

According to recent IRS guidance, tax credit seekers have until September 30, 2025, to "acquire" vehicles through a binding written contract and either a nominal downpayment or a trade-In, to obtain a Section 45W Clean Commercial Vehicle Tax Credit.

Deadlines and IRS Guidance for Claiming Section 45W Clean Commercial Vehicle and 30C Alternative Fuel Tax Credits

Although One Big Beautiful Bill (the “OBBB”) shortened the availability of a number of tax credits, there is still a window of opportunity for governmental entities, nonprofits and taxpayers to receive a Section 45W Clean Commercial Vehicles Tax Credit for clean commercial vehicles, including EV, fuel cell or hybrid school buses, trucks, vans, and forklifts.1 The OBBB provided that vehicles must be acquired by September 30, 2025 to receive the Section 45W tax credit.

On August 21, 2025, the IRS released FAQs regarding, among other things, Section 45W Clean Commercial Vehicles Tax Credits, which clarify that a vehicle is "acquired" as of the date a written binding contract is entered into and a payment has been made (including either a nominal down payment or a vehicle trade-in).

Although acquiring a vehicle prior to the termination date is essential, the acquisition alone does not immediately entitle a taxpayer to a credit. Section 45W(a) requires the vehicle to be “placed in service” to claim the respective credit. If a taxpayer acquires a vehicle by having a written binding contract in place and a payment made on or before September 30, 2025, then the taxpayer will be entitled to claim the credit when they place the vehicle in service (namely, when they take possession of the vehicle), even if the vehicle is placed in service after September 30, 2025. Taxpayers should make sure that they receive a time of sale report from the dealer at the time they take possession or within three days of taking possession of the vehicle.

The new user registration for the Clean Vehicle Credit program through the Energy Credits Online portal will close on September 30, 2025. The portal will, however, remain open beyond September 30, 2025, for limited usage by previously registered users, to submit time of sale reports and updates to such reports, such as when a vehicle has been returned.

The OBBB also shortened the availability of the Section 30C Alternative Fuel Vehicle Refueling Property Tax Credit, which is still available for EV chargers and other alternative fueling stations. To receive the Section 30C tax credit, the project must be placed in service by June 30, 2026.

Tax credit seekers should generally be able to rely on these FAQs, but the IRS explicitly stated that if an FAQ turns out to be an inaccurate statement of the law as applied to a particular taxpayer's case, the law will control the taxpayer's tax liability. In addition, because these FAQs have not been published in the Internal Revenue Bulletin, they will not be relied on or used by the IRS to resolve a case. However, a taxpayer who reasonably and in good faith relies on these FAQs will not be subject to a penalty that provides a reasonable cause standard for relief, including a negligence penalty or other accuracy-related penalty, to the extent that reliance results in an underpayment of tax. Penalty relief will, however, likely be insufficient for taxpayers that make business decisions based upon these FAQs.

Additional details on OBBB’s impact on clean energy tax credits and other tax credits can be found in our earlier client alerts: Impact of 'One Big Beautiful Bill' on Clean Energy Tax Credits and Treasury Department Adds Restrictions to Beginning of Construction Rules for Wind and Solar Facilities.

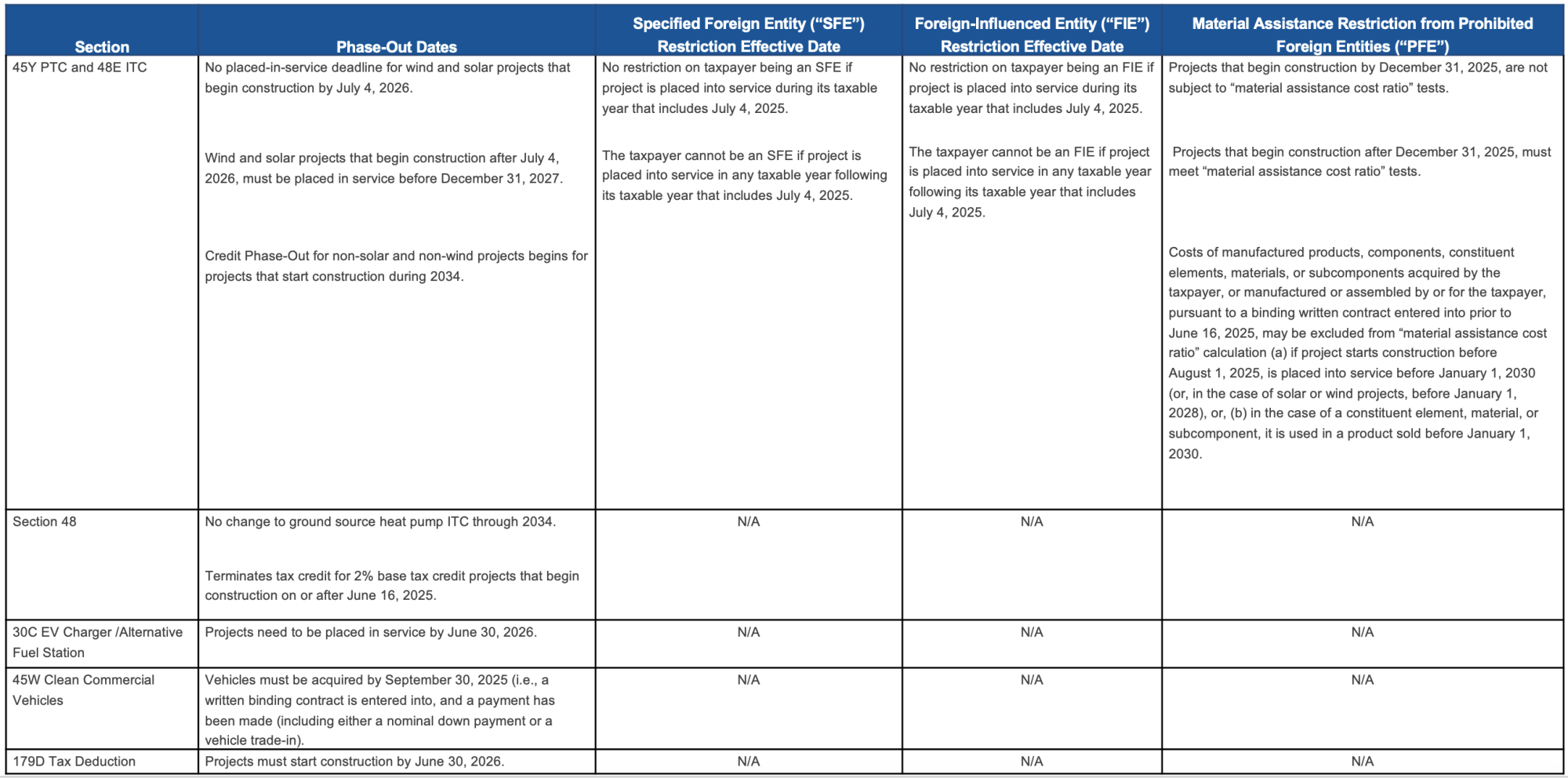

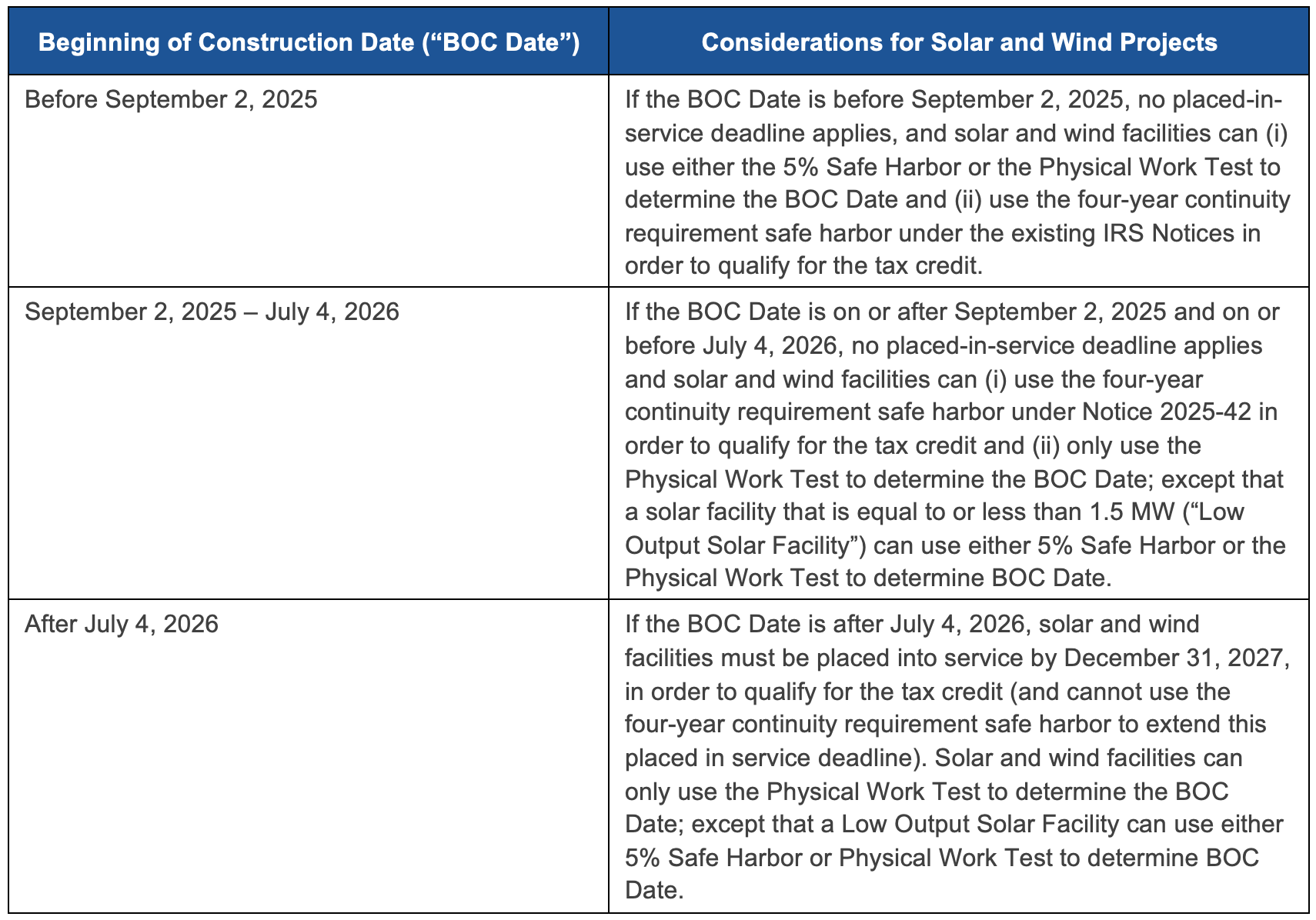

The following charts summarize the OBBB's impact on clean energy tax credits and other tax credits.

- The credit is the lesser of a percentage of the vehicle's cost (30% for fully electric/fuel cell, 15% for hybrids) or its "incremental cost" over a comparable gasoline/diesel vehicle. The credit is capped at $7,500 for vehicles with a gross vehicle weight rating under 14,000 pounds and $40,000 for vehicles 14,000 pounds or over.