Client Alert

IRS Announces Online Pre-Registration Portal for IRA Elective Pay and Transferability of Tax Credits

On December 22, 2023, the Internal Revenue Service unveiled its online pre-registration portal for elective pay (or “direct pay”) and transferability of tax credits under the Inflation Reduction Act (the “IRA”).

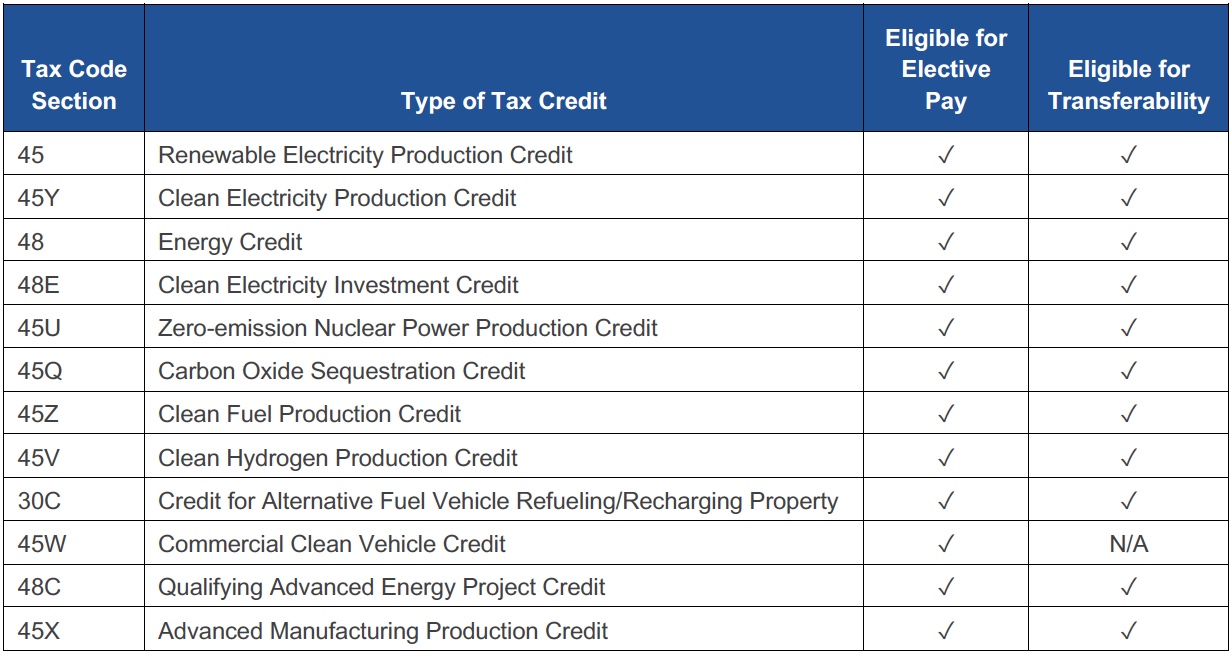

States, local governments, non-profits, tribal entities, rural electric cooperatives, and other eligible entities seeking to receive a direct payment for any of the following twelve tax credits and taxpayers seeking to transfer any of the following eleven tax credits must pre-register and receive a registration number for the project using the portal:

Eligible entities should pre-register using the online portal:

- After placing an investment property or production facility in service, but no earlier than the beginning of the tax period when the tax credit is earned.

- At least 120 days before the due date (including extensions) for the return where the tax credit will be reported. The IRS notes that this should allow time for IRS review and for the taxpayer to respond if the IRS requires additional information before issuing the registration numbers. The IRS will work to issue a registration number even where the registration submission is made close in time before the registrant’s filing deadline. In such cases, the registrant should anticipate that the tax return on which the elective payment or transfer election is made may undergo heightened scrutiny to mitigate the risk of fraud and duplication that pre-filing registration is intended to address before a payment is issued.

Additionally, the IRS notes:

- The registration number must be included on the entity’s tax return when making an election for elective payment or transfer for a tax credit.

- The IRS intends to review and process registration submissions through the IRA/CHIPS Pre-Filing Registration tool in the order it receives them. A registrant cannot request expedited handling.

- If the registrant chooses to make additional pre-filing registration submissions for different facilities/ properties, the registrant must wait until the most recent pre-filing registration submission is processed by the IRS and returned.

- The IRS may consider a registrant’s tax period ending date when managing the pre-filing registration caseload.

An IRS user guide for the portal can be found here and a video tutorial here.

On Wednesday, January 17, at 1:30 p.m. EST, the Department of Treasury will host an elective pay webinar and provide an overview of the pre-filing registration process. Registration in advance for this briefing is available here.

IRS Transitional Guidance on Phaseout of Elective Pay for Failure to Meet Domestic Content

Separately, on December 28, 2023, the IRS released Notice 2024-9, which provides relief for taxpayers facing a phaseout of elective pay tax credits related to a failure to meet certain domestic content requirements. The IRA provides that the amount of an elective payment for tax credits under § 45, 45Y, 48, or 48E (relating to clean energy production or investment tax credits) is reduced (or “phased out”) for a project of 1 MW or more that begins construction on or after January 1, 2024, by 10%, if the percentage of the project’s steel, iron, and manufactured components that are sourced in the United States fails to satisfy certain minimum thresholds. The IRA directs the Treasury to provide exceptions from the phaseout if complying with the minimum thresholds would increase the cost of construction by more than 25 percent (the “Increased Cost Exception”) or if the steel, iron, and manufactured components are not produced in the United States in sufficient and reasonably available quantities or of a satisfactory quality (the “Non-Availability Exception”). Treasury and the IRS are requesting comments on each of the Increased Cost Exception and the Non-Availability Exception to inform the development of the forthcoming proposed regulations. Written comments are due by February 26, 2024.

The transitional IRS guidance provides that, for projects that begin construction before January 1, 2025, applicable entities can qualify for either exception by attaching an attestation regarding qualification to an IRS Form 8835, IRS Form 3468, or other applicable form filed with the IRS. The applicable entity must attest, under penalties of perjury, that it has reviewed the requirements for the Increased Cost Exception and the Non-Availability Exception provided under §§ 45(b)(10)(D), 48(a)(13), 45Y(g)(12)(D), or 48E(d)(5), as applicable, and has made a good faith determination that the qualified facility, energy project, or qualified investment with respect to a qualified facility or energy storage technology, as applicable, qualifies for either the Increased Cost Exception or the Non-Availability Exception, or both. The attestation must be signed by a person with the legal authority to bind the applicable entity in federal tax matters. An applicable entity providing such an attestation must meet the general recordkeeping requirements under § 6001 and the regulations thereunder to substantiate its attestation. The IRS intends to provide more detailed regulatory guidance in the future that will apply to projects that begin construction on or after January 1, 2025.

Chapman and Cutler LLP continues to monitor developments relating to the Inflation Reduction Act and will provide further updates as they arise.