Client Alert

Our December 6, 2023 Client Alert described very generally important aspects of the “Basel III Endgame” NPR (NPR) that proposed replacing two “subparts” of the existing US Basel III rule. In that Alert, we indicated we would issue a separate Client Alert describing in more detail how the Standardized Approach “risk weights” in Section 32 and “credit conversion factors” (CCFs) in Section 33 of the US Basel III rule differ from the risk weights and CCFs proposed in the NPR (which would be contained in proposed Sections 111 and 112 of the US Basel III rule). This Alert provides that description. This Client Alert does not address the risk weights for securitization exposures. For a discussion of the impact of the Basel II endgame proposal on securitization exposures, please see our Client Alert dated August 1, 2023, a copy of which can be found here.

Pages 2-11 of the Federal Reserve’s Regulation Q “Standardized Approach” linked here contain Sections 32 and 33 of the US Basel III rule discussed below. Pages 64187-64193 of the NPR linked here contain proposed Sections 111 and 112 for the ERB Approach discussed below.

Risk Weights Under the Proposed ERB Approach

How would the proposed new Subpart E ERB Approach differ from the existing

Subpart E Advanced Approaches?

Completely. The proposed ERB Approach is based upon the “standardized approach” contained in the updated “Basel Framework” finalized in 2017. That standardized approach retains the basic features of the original 1988 “Basel Accord” that assigned risk weights to various categories of counterparties and “credit conversion factors” to “off-balance sheet exposures” so that both on-balance sheet exposures (at par) and of-balance sheet exposures (based on their CCFs) could be “risk weighted” to produce “risk weighted assets.” The proposed ERB approach would be a new version of this basic approach, different from the Subpart D Standardized Approach (which would remain in effect) by providing different risk weights for some exposures (including some newly identified types of exposures) and different CCFs for some off-balance sheet exposures.

The Advanced Approaches and their basis in “internal bank models” would be completely eliminated. No element of that approach would remain in Subpart E. Instead, the agencies will provide risk weights under two different versions of structurally similar “standardized approaches,” the continuing Subpart D Standardized Approach used by all US banks subject to risk-based capital standards, and the new Subpart E updated “standardized approach,” to be known as the ERB Approach, to be used as an alternative method by all Category I-IV banks, which will be the relevant measure for capital compliance, if it produces larger RWAs than the Standardized Approach, as expected.

How do risk weights in the proposed ERB Approach differ from existing risk weights in the

Standardized Approach?

The Standardized Approach lists 13 categories of “exposures” for which it assigns “risk weights” in Section 32(a)-(m) of the US Basel III rule. The proposed ERB Approach would list 11 categories of “exposures” for which it would assign “risk weights” in the proposed Section 111(a)-(k) of the US Basel III rule.

The difference in the number of subsections results from the proposed ERB Approach Section 111(f) specifying risk weights for all the different forms of real estate exposures identified in the Standardized Approach Sections 32(g)-(j), along with other forms of real estate exposures. In addition, the proposed Section 111(g) would specify risk weights for “retail exposures,” which are not addressed specifically in Sections 32 of the Standardized Approach.

The existing language in the Standardized Approach’s Section 32(a), for “sovereign exposures, 32(b), for “certain supranational entities and multilateral development banks (MDBs),” Section 32(e) for “public sector entities (PSEs),” Section 32(l) for “other assets” and Section 32(m) for “insurance assets” would be repeated verbatim in the ERB Approach proposed Sections 111(a), (b), (e), (j) and (k). The risk weights for these exposures would therefore be the same under the Standardized Approach and the proposed ERB Approach.

The proposed ERB Approach would assign risk weights different from the Standardized Approach to at least some exposures in each of the broad categories of exposures covered by Sections 32(c), (d), and (f)-(k) of the Standardized Approach. Thus, Sections 111(c), (d), and (f)-(i) of the proposed ERB Approach would assign risk weights different from the Standardized Approach to:

- subordinated debt instruments issued by GSEs, banks, or corporations;

- exposures to banks based on their investment grade and capital compliance status;

- real estate exposures based on factors not mentioned in the Standardized Approach;

- retail exposures based on factors not mentioned in the Standardized Approach, which does not specifically address retail exposures at all;

- corporate exposures based on investment grade and public debt criteria and project finance status, along with subordinated debt, as mentioned above in clause (1);

- defaulted exposures based on criteria not mentioned in the Standardized Approach.

How would the proposed ERB Approach risk weight exposures to GSEs differently than the

Standardized Approach?

The only difference is that the proposed ERB Approach would assign a 150% risk weight to a “subordinated debt instrument” issued by a GSE. Otherwise, like the Standardized Approach, the proposed ERB Approach would assign a 20% risk weight to all other GSE debt and a 100% risk weight to preferred stock in a GSE, with other GSE equity treated by the equity interest provisions of the US Basel III rule.

The Standardized Approach makes no distinction between senior and subordinate debt issued by any obligor. Other than for subordinated debt instruments of a Federal Home Loan Bank or of Farmer Mac, which would receive a 20% risk weight, the proposed ERB Approach would assign risk weights to subordinated debt instruments issued by GSEs of 150)%, so that exposures to subordinated debt instruments issued by GSEs, would be treated the same as such exposures to banks and corporations.

How would the proposed ERB Approach risk weight exposures to US banks differently than the

Standardized Approach?

The Standardized Approach risk weights all exposures to US banks (meaning depository institutions, not BHCs) at 20%. The proposed ERB Approach would risk weight an exposure to such a US bank at 20%, 40%, 50%, 75%, or 150% depending upon the type of exposure and a combination of the investment grade status and capital rule compliance of the relevant bank.

First, the proposed ERB Approach would divide US banks into three categories:

- Grade A Banks: banks that are investment grade (as currently defined in the US Basel III rule) and meet all applicable minimum capital and capital buffer requirements, so that the bank is not subject to limitations on distributions and discretionary bonus payments, and is “well capitalized” under “prompt corrective action” standards (PCA).

- Grade B Banks: banks that are not Grade A banks, but are either investment or speculative grade,1 meet all minimum capital requirements, and are categorized as at least “adequately capitalized” under PCA.

- Grade C Banks: banks that are neither Grade A nor Grade B, including banks that have not disclosed their capital ratios in the past 6 months or for which an external auditor has issued an adverse opinion or, in the past 12 months, has expressed substantial doubt about the ability of the bank to continue as a going concern.

Second, the proposed ERB Approach would divide exposures to US banks into two categories:

- Trade Credit, defined as “self-liquidating, trade-related contingent items that arise from the movement of goods and have maturities of three months or less.”

- Base Credit, which covers all bank exposures other than Trade Credit.

For exposures to:

- Grade A US banks, Trade Credit would receive a 20% risk weight and Base Credit would receive a 40% risk weight.

- Grade B US banks, Trade Credit would receive a 50% risk weight and Base Credit would receive a 50% risk weight.

- Grade C US banks, both Trade Credit and Base Credit would receive a 150% risk weight.

Exposures to US banks would, therefore, receive higher risk weights than under the Standardized Approach in all circumstances except Trade Credit to a Grade A US bank, which would receive the same 20% risk weight as ALL exposures to ALL US banks receive under the Standardized Approach.

In addition, an exposure to a US bank that arises from either a “subordinated debt instrument” (defined as for a GSE) or a “covered debt instrument” (such as TLAC or equivalent “bail in equity”2) would receive a 150% risk weight.

How would the proposed ERB Approach risk weight exposures to non-US banks differently than the Standardized Approach?

The Standardized Approach assigns different risk weights to non-US bank exposures based upon the CRC (country rating classification), Sovereign Default, and OECD membership status of the bank’s home country. For banks from OECD member countries this produces the same uniform 20% risk weight for all exposures to such banks as US bank exposures receive.3

The proposed ERB Approach would assign to foreign bank exposures the same risk weights as described above for US banks, with Grade A-C Bank status determined by the same criteria as US banks, except (when not applicable to a foreign bank) PCA status would not apply, and foreign capital compliance would apply unless US rules applied to the bank for dividend and other distribution restrictions.

Thus, the separate risk weights for US and foreign banks in the Standardized Approach (which is really only for banks from non-OECD countries) would not exist in the proposed ERB Approach, except that foreign banks would have a minimum risk weight no lower than the risk weight for their home country (i.e., the risk weight for a “sovereign exposure” to that country). This would presumably only be a potential issue for non-OECD countries unless an OECD country entered Sovereign Default status.

How would the proposed ERB Approach risk weight real estate exposures differently than the

Standardized Approach?

The Standardized Approach assigns different risk weights to four types of real estate exposures:

- Residential mortgage exposures (Section 32(g)):

50% risk weight for first-lien mortgage on owner-occupied (or rented) property on loan made in accordance with prudent underwriting standards that is not 90 days or more past due, in nonaccrual status, or either restructured or modified. 100% risk weight for junior lien and any first lien residential mortgage exposure that does not meet all such criteria (including a past due first lien mortgage). - Pre-sold construction loans (Section 32(h)):

50% for noncancelled and 100% for cancelled purchase contracts. - Statutory multifamily mortgage exposures4 (Section 32(i)):

50%. - High volatility commercial real estate (HVCRE) exposures5 (Section 32(j)):

150%.

Other than residential mortgage exposures (which receive a 100% risk weight when in default), past due exposures listed above would receive a 150% risk weight under Section 32(k), as described below.

The proposed ERB Approach would assign risk weights to eight types of real estate exposures:

- Statutory multifamily mortgage exposures (Section 111(f)(1)):

Same 50% as Standardized Approach, so long as not defaulted real estate exposures. - Pre-sold construction loans (Section 111(f)(2)):

Same 50% for uncancelled (so long as not defaulted real estate exposures) and 100% for cancelled as Standardized Approach. - HVCRE exposures (Section 111(f)(3)):

Same 150% as Standardized Approach, so long as not a defaulted real estate exposure. - Acquisition, development, or construction (ADC) exposures6 (Section 111(f)(4)):

100%, so long as not an HVCRE.7 - Regulatory residential real estate exposures (defined almost exactly the same as the 50% risk weighted residential real estate exposure described in item 1 of the previous answer for the Standardized Approach8) (Section 111(f)(5)):

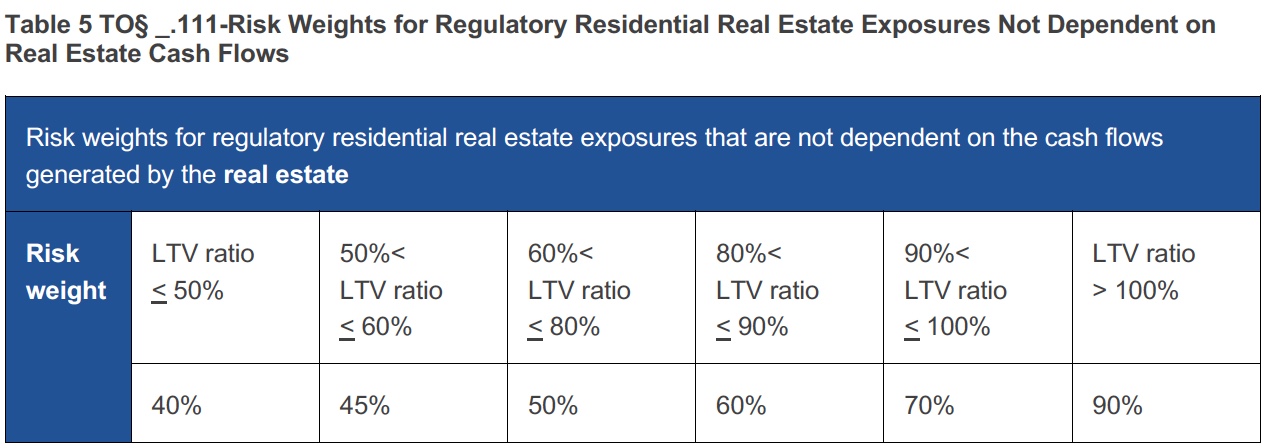

If not “cash flow dependent,” according to “loan to value” (LTV) status, as specified in Table 5 to the proposed ERB Approach rule:

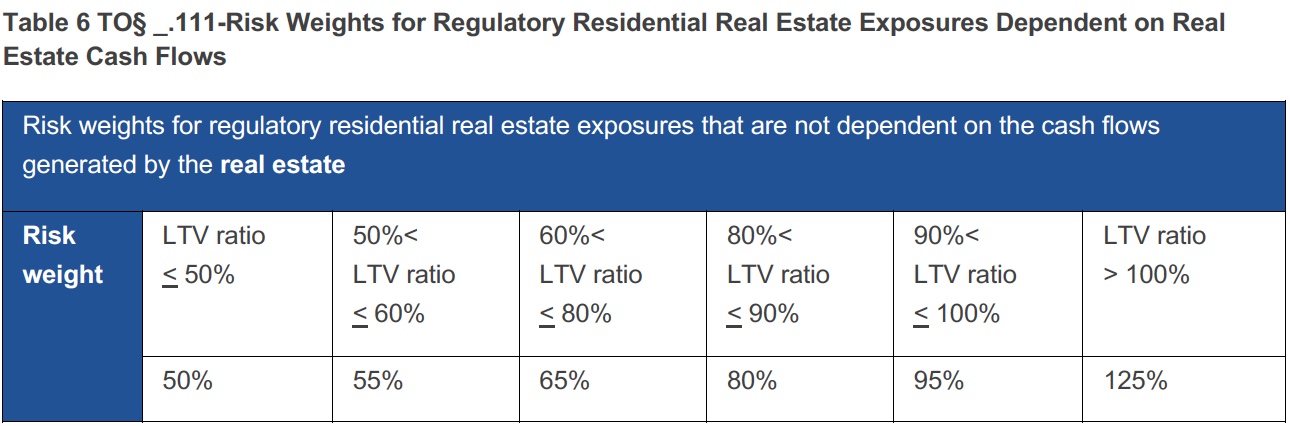

If dependent up “cash flow,” according to “loan to value” (LTV) status, as specified in Table 5 to the proposed ERB Approach rule:

Under the proposed rule, a regulatory residential real estate exposure would be “dependent on the cash flows generated by the real estate” if the bank holding the exposure had treated “the cash flows generated by lease, rental, or sale of the real estate securing the loan as a source of repayment” in its underwriting of the exposure at origination.9

The Standardized Approach does not vary risk weights for any type of exposure based on whether it is “cash flow dependent,” a subordinate claim, or “project finance.” The proposed ERB Approach would introduce these distinctions, and these distinctions are contained in the “standardized approach” of the Basel Framework finalized in 2017 that forms the basis for the ERB Approach.

- Regulatory commercial real estate exposures10 (Section 111(f)(6)):

As with regulatory residential real estate exposures, risk weights would vary depending upon whether the exposure is “cash flow dependent” and upon LTV ratios.

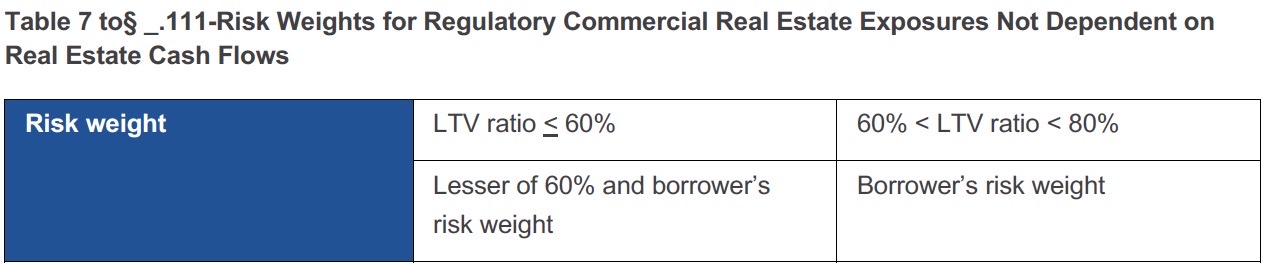

For non-cash flow dependent exposures, Table 7 to the ERB Approach proposed rule assigns risk weights as follows:

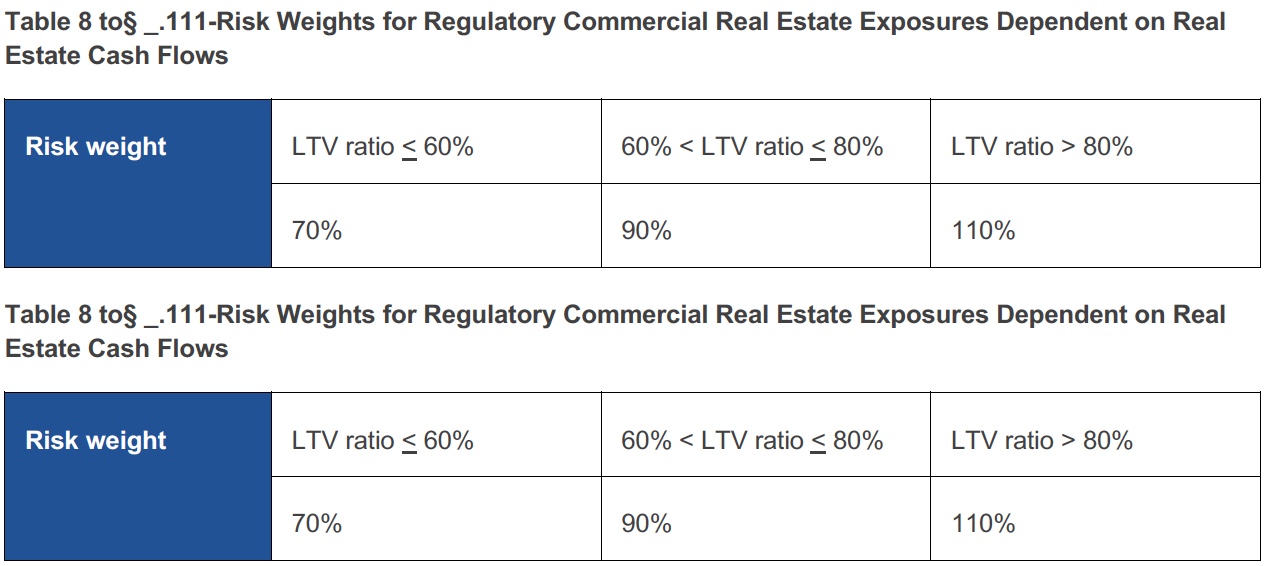

For cash flow dependent regulatory commercial real estate exposures, Table 8 in the proposed ERB Approach rules assigns risk weights:

- Other real estate exposures (Section 111(f)(7)):

150%, unless the exposure is a residential mortgage exposure that is not dependent on the cash flows generated by the real estate, which must be assigned a 100% risk weight. - Defaulted real estate exposures (Section 111(f)(8)):

150%, except a residential mortgage exposure that is not dependent on the cash flows generated by the real estate, which must be assigned a 100 % risk weight.

In addition, the ERB Approach would add a “risk weight multiplier” of 1.5 to “a residential mortgage exposure to a borrower that does not have a source of repayment in the currency of the loan equal to at least 90 percent of the annual payment from either income generated through ordinary business activities or from a contract with a financial institution that provides funds denominated in the currency of the loan,” subject to the maximum resulting risk weight being 150% (i.e., the multiplier on any exposure with a basic risk weight of more than 100% would not increase the risk weight above 150%).

The Standardized Approach does not assign different risk weights to any exposure based on currency mismatches of any kind and does not address that issue in any way.

What is a retail exposure under the proposed ERB Approach?

Section 101 of the proposed ERB Approach defines a retail exposure as an exposure that is not a real estate exposure and that is either: (1) an exposure to a natural person or persons, or (2) an exposure to a small or medium-sized enterprise that satisfies the criteria in the definition of regulatory retail exposure described further below.

How would the proposed ERB Approach risk weight retail exposures differently than the

Standardized Approach?

The Standardized Approach does not assign risk weights to, or even mention, retail exposures. Such exposures would receive a 100% risk weight under the Standardized Approach either because they would be corporate exposures or exposures not mentioned in Section 32, which therefore automatically receive a 100% risk weight.11

The proposed ERB Approach would assign risk weights of:

- 85% to a “regulatory retail exposure”12 that is not a transactor exposure.13”

- 55% to a regulatory retail exposure that is a transactor exposure.

- 110% to all other retail exposures (e., all retail exposures that are not regulatory retail exposures).

In addition, any foreign currency denominated retail exposure would be subject to the same 1.5 multiplier as a residential real estate exposure, subject to the same 150% risk weight limit.

How would the proposed ERB Approach risk weight corporate exposures differently than the Standardized Approach?

The Standardized Approach risk weights all corporate exposures14 at 100%., except exposures to a “qualified central counterparty” (QCCP), which receive a 2% or 4% risk weight depending upon the type of cash collateral transaction posting that creates the exposure.

The proposed ERB Approach would assign a 100% risk weight to any corporate exposure other than:

- “an exposure to a company that is investment grade and that has a publicly traded security outstanding or that is controlled by a company that has a publicly traded security outstanding” (which exposure would receive a 65% risk weight). (Section 111(h)(1)).

- “a project finance exposure that is not a project finance operational phase exposure” (which exposure would receive a 130% risk weight). (Section 111(h)(2)).

- QCCP exposures, which would receive the same risk weights as in the Standardized Approach.

(Section 111(h)(3)). - an exposure to a subordinated debt instrument or a “covered debt instrument,” both of which would receive a 150% risk weight (Section 111(h)(4)). A “covered debt instrument” would be TLAC or equivalent debt, as currently defined in the US Basel III rule to deal with G-SIB issued instruments designed to function as

“bail-in equity.”15

How would the proposed ERB Approach treat defaulted exposures differently from the existing

Standardized Approach treatment?

The Standardized Approach generally assigns a 150% risk weight to a “past due exposure” that is not guaranteed (if it meets the requirements of Section 36 of the US Basel III rule) or secured (if it meets the requirements of Section 37), if the exposure is not a “sovereign exposure,” “residential mortgage exposure,” or “policy loan.” The Standardized Approach defines a “past due exposure” as one that is 90 days past due or on nonaccrual.

Under the Standardized Approach, a sovereign exposure receives a special 150% “sovereign default” risk weight, a “residential mortgage exposure” receives a specific 100% risk weight if 90 days past due or on nonaccrual, and policy loans receive a 20% risk weight regardless of any “default.”

The ERB Approach would similarly assign a 150% risk weight to a “defaulted exposure,” unless it were a sovereign exposure, real estate exposure, or policy loan. The term “defaulted exposure,” however, would be defined in a much more elaborate way to include “cross default” coverage for defaults to third party lenders and other measures intended to “capture the elevated credit risk of exposures where the banking organization’s reasonable expectation of repayment has been reduced.”16 The proposal would separately define “defaulted exposures” for retail and non-retail exposures and create a special definition for a “defaulted real estate exposure.”17

Credit Conversion Factors Under the Proposed ERB Approach:

How would the proposed ERB Approach treat off-balance sheet exposures differently from the Standardized Approach in assigning “credit conversion factors” (CCFs) for establishing the “credit equivalent amounts” of off-balance sheet exposures?

The Standardized Approach assigns CCFs of 0%, 20%, 50%, and 100% to four separate categories of off-balance sheet exposures. The proposed ERB Approach would assign CCFs of 10%, 20%, 40%, 50%, and 100% to four separate categories of off-balance sheet exposures. As discussed above, a detailed treatment of securitization exposures is outside the scope of this Client Alert. Most types of off-balance sheet securitization exposures have an effective credit conversion factor of 100% in both the Standardized Approach and the proposed ERB Approach.18

The Standardized Approach CCF categories are:

| 0%: |

the unused portion of an unconditionally cancelable commitment. |

| 20%: |

commitments with an original maturity of one year or less that are not unconditionally cancelable and trade-related contingent items related to the movement of goods with a maturity of one year or less (such as commercial letters of credit). |

| 50%: |

commitments with an original maturity of more than one year that are not unconditionally cancelable and “transaction-related” contingent items (such as performance bonds or letters of credit, as opposed to financial letters of credit). |

| 100%: |

financial letters of credit and other items (such as representations warranties) that perform as guarantees, plus repurchase or forward agreements. |

The proposed ERB Approach CCF categories would be:

| 10%: |

the unused portion of an unconditionally cancelable commitment. |

| 20%: |

trade-related contingent items related to the movement of goods with a maturity of one year or less (such as commercial letters of credit). |

| 40%: |

all commitments, regardless of maturity, that do not qualify for a lower (see 10%) or higher (see 50% for NIFs and RUFs). |

| 50%: |

“transaction-related” contingent items (such as performance bonds or letters of credit, as opposed to financial letters of credit) plus note issuance and revolving underwriting facilities (NIFs and RUFs). |

| 100%: |

financial letters of credit and other items (such as representations warranties) that perform as guarantees, plus repurchase or forward agreements. |

Thus, the ERB Approach would apply higher CCFs to unconditionally cancelable commitments (10% versus 0%) and commitments with an original maturity of one year or less (40% versus 20%), while imposing a lower 40% CCF to commitments of more than one year (compared to 50%), so long as those commitments are not NIFs or RUFs.

- Defined to only include an entity that “has adequate capacity to meet financial commitments in the near term” among other conditions.

- See the definition in Section 217.2 of the Federal Reserve’s Regulation Q https://www.ecfr.gov/current/title-12/chapter-II/subchapter-A/part-217/subpart-A/section-217.2

- Technically, exposures to a bank from an OECD member country could receive a higher risk weight if that country received a CRC rating higher than 1 or fell into Sovereign Default. As a practical matter, OECD countries do not receive CRC ratings (and, therefore, banks from such countries receive a 20% risk weight as their home countries are OECD members “without CRC” rating), so that only Sovereign Default status could produce a risk weight higher than 20% under the Standardized Approach. There has been no Sovereign Default in an OECD member country.

- As defined in Section 2 of the US Basel III rule.

- As defined in Section 2 of the US Basel III rule.

- See the definition on page 64183 of the NPR, which specifies “Acquisition, development, or construction exposure (ADC) exposure means a loan secured by real estate for the purpose of acquiring, developing, or constructing residential or commercial real estate properties, as well as all land development loans, and all other land loans.

- Any ADC exposure that is also an HVCRE exposure would be treated as an HVCRE exposure and, therefore, receive a 150% risk weight.

- See the definition on page 64186 of the NPR, which specifies the exposure: (i) Is secured by a property that is either owner-occupied or rented; (ii) Is made in accordance with prudent underwriting standards, including standards relating to the loan amount as a percent of the value of the property; (iii) During underwriting of the loan, the [BANKING ORGANIZATION] must have applied underwriting policies that took into account the ability of the borrower to repay in a timely manner based on clear and measurable underwriting standards that enable the [BANKING ORGANIZATION] to evaluate these credit factors; and (iv) The property must be valued in accordance with §ll.103.

- The proposed ERB Approach would add this definition: Dependent on the cash flows generated by the real estate means, for a real estate exposure, for which the underwriting, at the time of origination, includes the cash flows generated by lease, rental, or sale of the real estate securing the loan as a source of For purposes of this definition, a residential mortgage exposure that is secured by the borrower’s principal residence is deemed not dependent on the cash flows generated by the real estate. (Section 101(b)).

- Regulatory commercial real estate exposure means a real estate exposure that is not a regulatory residential real estate exposure, a defaulted real estate exposure, an ADC exposure, a pre-sold construction loan, a statutory multifamily mortgage, or an HVCRE exposure, and that meets the following criteria:

(1) The exposure must be primarily secured by fully completed real estate;

(2) The [BANKING ORGANIZATION] holds a first priority security interest in the property that is legally enforceable in all relevant jurisdictions; provided that when the [BANKING ORGANIZATION] also holds a junior security interest in the same property and no other party holds an intervening security interest, the [BANKING ORGANIZATION] must treat the exposures as a single regulatory commercial real estate exposure;

(3) The exposure is made in accordance with prudent underwriting standards, including standards relating to the loan amount as a percent of the value of the property;

(4) During underwriting of the loan, the [BANKING ORGANIZATION] must have applied underwriting policies that took into account the ability of the borrower to repay in a timely manner based on clear and measurable underwriting standards that enable the [BANKING ORGANIZATION] to evaluate relevant credit factors; and

(5) The property must be valued in accordance with §ll.103. - Under Section 32(l)(5) of the Standardized Approach, a banking organization must assign a 100% risk weight to all assets that are not assigned a different risk weight under the Standardized Approach and that are not required to be deducted from capital.

- A “regulatory retail exposure” is defined in Section 101 of the proposed ERB Approach as a retail exposure that meets all of the following criteria: (1) The exposure is a revolving credit or line of credit, or a term loan or lease; (2) The sum of the exposure amount and the amounts of all other retail exposures to the obligor and to its affiliates does not exceed $1 million; and (3) notwithstanding (1) and (2) above, if a retail exposure exceeds 0.2 percent of the banking organization’s total retail exposures that meet criteria (1) and (2) above, only the portion up to 0.2 percent of the banking organization’s total retail exposures may be considered a regulatory retail exposure. For purposes of clause (3), off-balance sheet exposures are measured by applying the appropriate credit conversion factor and defaulted exposures are excluded.

- Section 101 of the proposed ERB Approach defines a “transactor exposure” as a regulatory retail exposure that is a credit facility where the balance has been. repaid in full at each scheduled repayment date for the previous 12 months or an overdraft facility where there has been no drawdown over the previous 12 months.

- Corporate exposures do not include exposures to GSEs, banks, or other types of obligors specifically mentioned in Section 32 that are organized as corporations.

- For US G-SIBs, see 12 CFR 252.61 https://www.ecfr.gov/current/title-12/chapter-II/subchapter-A/part-252/subpart-G/section-252.61 For non-US IHCs, see 12 CFR 252.161.

- NPR page 64039 under “a. Defaulted Exposures.”

- See NPR page 64184 for those proposed definitions.

- SeeSection 42(c)(3) of the Standardized Approach and Section 131(b) of the proposed ERB Approach.