Client Alert

Executive Summary: 5% Safe Harbor Terminated for Applicable Wind and Solar Facilities, Other Than Low Output Solar Facilities

IRS Notice 2025-42 provides that wind and solar facilities that start construction on or after September 2, 2025 may not rely on the 5% Safe Harbor to establish the beginning of construction date in determining whether an applicable wind or solar facility is subject to the accelerated placed-in-service requirement of Section 45Y and 48E tax credits under the One Big Beautiful Bill Act, enacted on July 4, 2025 (the “OBBBA”). In addition, Notice 2025-42 provides an exception for “Low Output Solar Facilities” to continue to use the 5% Safe Harbor.

Elimination of the 5% Safe Harbor is most likely to affect wind and solar facilities that are not already subject to binding construction and procurement contracts, as developers of those facilities will be scrambling in the next few months to complete design, funding and other development work so that they can execute construction and procurement contracts and commence physical work as soon as possible and by July 4, 2026.

Background

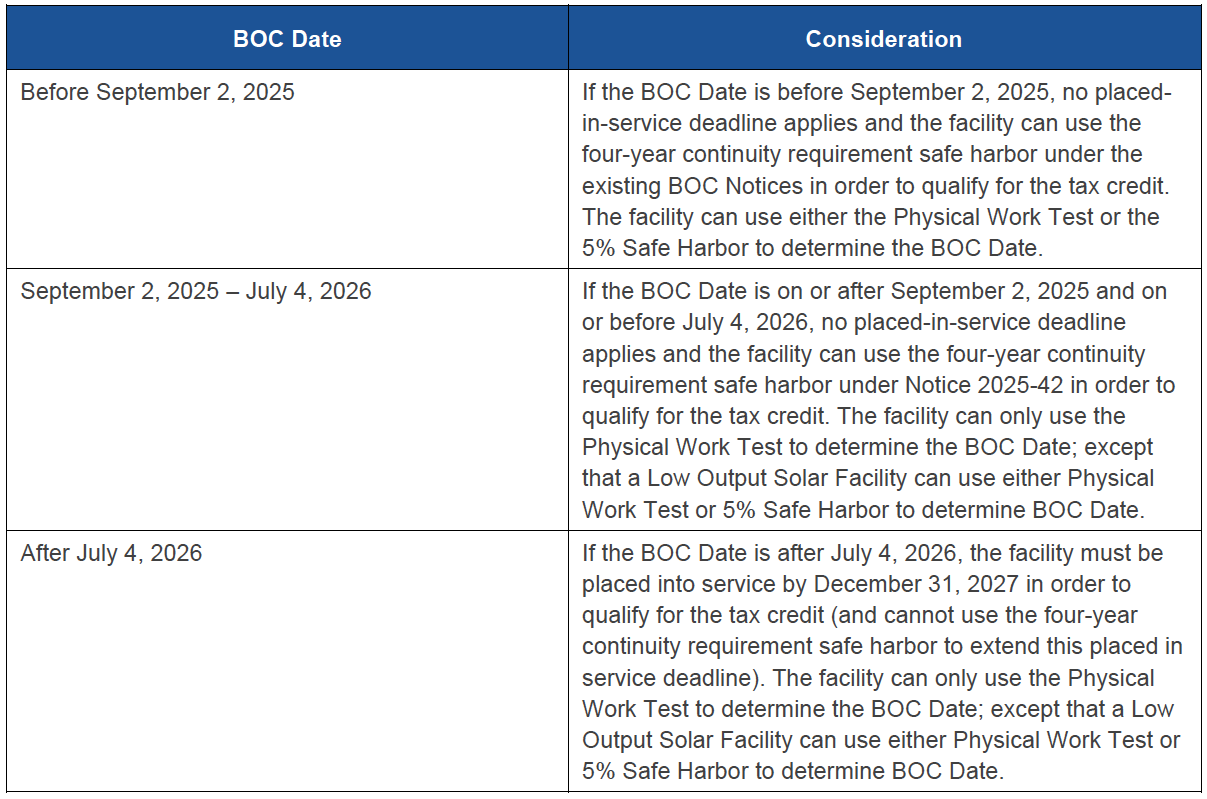

The OBBBA drastically limited the availability of clean electricity investment and production tax credits under Sections 45Y and 48E of the Internal Revenue Code of 1986 (the “Code”). Under the OBBBA, wind and solar facilities that begin construction (within the meaning of the Code, as further discussed below) after July 4, 2026 must be placed in service by December 31, 2027 in order to qualify for the applicable tax credit.

Executive Order 143151 directed the Treasury Department “to strictly enforce the termination of the clean electricity production and investment tax credits under Sections 45Y and 48E of the Internal Revenue Code for wind and solar facilities.” To that end, the order directed the Treasury Department to issue guidance that would “ensure that policies concerning the ‘beginning of construction’ are not circumvented, including by preventing the artificial acceleration or manipulation of eligibility and by restricting the use of broad safe harbors unless a substantial portion of a subject facility has been built.” In furtherance of this executive order, the Treasury Department issued Notice 2025-42 on Friday, August 15, 2025.

Notice 2025-42 applies to “applicable wind facilities” and “applicable solar facilities,” as defined in the OBBBA, which are generally facilities that use wind or solar energy to produce electricity, respectively. Notice 2025-42 applies to applicable wind or solar facilities unless construction begins under existing rules before September 2, 2025 (as determined under Section 5 of Notice 2022-61).2

As discussed below, Notice 2025-42 eliminates the 5% Safe Harbor for establishing the beginning of construction date for applicable wind and solar facilities (other than Low Output Solar Facilities, as defined below) for the purposes of the OBBBA provisions that terminate tax credits under Sections 45Y and 48E. Historically, developers of these facilities have been able to rely on the 5% Safe Harbor to establish the beginning of construction. Moreover, some developers have accelerated costs for wind and solar facilities in the hopes of establishing a beginning of construction date as soon as possible in order to avoid these new restrictions.

Given the short deadlines to qualify for a tax credit under the OBBBA’s termination provisions, elimination of the 5% Safe Harbor will require developers to rely on the Physical Work Test without a fallback position. Since the Physical Work Test is a facts-and-circumstances test with no bright-line rules, reliance on the Physical Work Test is sure to increase the uncertainty inherent in qualifying for Section 45Y and 48E tax credits before they are terminated.

Existing Law

The IRS’s existing rules for determining when construction of a facility begins (the “BOC Date”) are provided in a series of IRS Notices (the “BOC Notices”).3 The BOC Notices provide two methods for determining the BOC Date, known as the “Physical Work Test” and the “5% Safe Harbor.” Under the BOC Notices, both methods are subject to a continuity requirement, which requires the taxpayer to use continuous efforts to advance towards completion of the facility’s construction after the BOC Date.

The existing Physical Work Test provides that the BOC Date occurs in the year in which physical work of a significant nature begins with respect to a facility. This determination is a facts-and-circumstances test, which requires consideration of all factors that may be relevant to the determination. Physical work of a significant nature for this purpose is meant to include actual physical work and does not include preliminary “development” activities.

The existing BOC Notices also provide a 5% Safe Harbor that focusses on costs paid or incurred rather than physical work to determine the BOC Date. Under the 5% Safe Harbor, the BOC Date of a facility occurs in the year in which at least 5% of the total cost of the facility is paid or incurred. However, this 5% must take into account the total cost of the facility at the time the facility is placed in service, so if there are cost overruns and it turns out that the taxpayer paid or incurred on the BOC Date less than 5% the total cost of the facility determined when the facility is eventually placed in service, the 5% Safe Harbor will not be satisfied. For this reason, most developers of wind and solar facilities who rely on the 5% Safe Harbor try to build in a cushion to account for potential cost overruns.

Both the Physical Work Test and the 5% Safe Harbor are subject to a continuity requirement, under which a taxpayer must make continuous efforts to advance toward completion of the facility after the BOC Date. The Physical Work Test is subject to a “continuous construction” requirement, under which a taxpayer must continue to perform physical work of a significant nature. The 5% Safe Harbor is subject to a slightly less stringent “continuous efforts” test, under which certain activities such as applying for permits may count towards the continuity requirement. The existing BOC Notices also include a list of “excusable disruptions” generally outside of the control of the taxpayer that do not prevent a taxpayer from satisfying the continuity requirement. Finally, the existing BOC Notices provide a safe harbor to the continuity requirement, under which a facility is deemed to satisfy the continuity requirement if it is placed into service before the end of the fourth calendar year after the calendar year in which construction begins (although excusable disruptions are not available to extend the four-year period for this safe harbor).

5% Safe Harbor Terminated for Applicable Wind and Solar Facilities, Other Than Low Output Solar Facilities

Notice 2025-42 provides that with respect to any BOC date on or after September 2, 2025, the Physical Work Test, as described in Notice 2025-42, is the sole method that a taxpayer may use to determine the BOC Date for purposes of establishing whether an applicable wind or solar facility is subject to the accelerated placed-in-service requirement for Section 45Y or 48E tax credits under the OBBBA. However, Notice 2025-42 provides an exception for “Low Output Solar Facilities” to continue to use the 5% Safe Harbor.

A Low Output Solar Facility is an applicable solar facility that has maximum net output equal to or less than 1.5 MW (as measured in alternating current), measured at the level of the qualified facility. If one or more applicable solar facilities have “integrated operations,” then those facilities are aggregated for the purpose of determining whether they exceed the 1.5-MW threshold. The output of an applicable solar facility is based on the nameplate capacity.

Physical Work Test under Notice 2025-42

The Physical Work Test as described in Notice 2025-42 provides that construction of an applicable wind or solar facility begins when physical work of a significant nature begins. Such physical work can be performed either on-site or off-site, and may be performed either by the taxpayer or by another person under a binding written contract that is entered into prior to the manufacture, construction, or production of the applicable wind or solar facility. Provided that physical work performed is of a significant nature, there is no fixed minimum amount of work or monetary or percentage threshold required to satisfy the Physical Work Test.

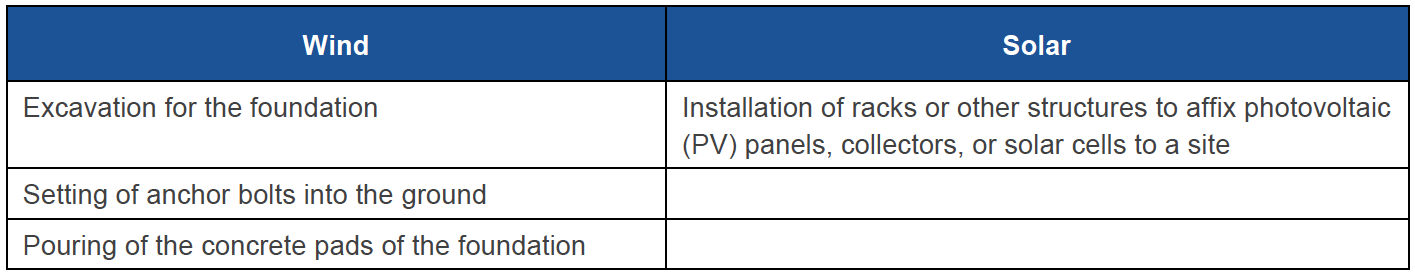

Notice 2025-42 includes the following list of examples of on-site activities that are considered physical work of a significant nature for applicable wind and solar facilities:

In the case of applicable wind facilities, Notice 2025-42 provides that if the applicable wind facility’s wind turbines and tower units are to be assembled on-site from components manufactured off-site by a person other than the taxpayer and delivered to the site, physical work of a significant nature begins when the manufacture of the components begins at the off-site location, but only if: (i) the manufacturer’s work is done pursuant to a binding written contract, and (ii) these components are not held in the manufacturer’s inventory. If a manufacturer produces components for multiple applicable facilities, a reasonable method must be used to associate individual components with particular applicable facilities.

In addition, Notice 2025-42 provides that off-site activities that generally constitute physical work of a significant nature may include the manufacture of components, mounting equipment, support structures such as racks and rails, inverters, and transformers (used in electrical generation that step up the voltage to less than 69 kilovolts) and other power conditioning equipment.

However, physical work of a significant nature does not include work (performed either by the taxpayer or by another person under a binding written contract) to produce a component or part of an applicable wind or solar facility that is either in existing inventory or is normally held in inventory. Additionally, Notice 2025-42 provides a list of activities that are preliminary and do not constitute physical work of a significant nature, such as planning, securing financing, and obtaining permits or licenses.4

The Physical Work Test, as described in Notice 2025-42, includes a continuous construction requirement that requires the taxpayer to maintain a continuous program of construction that involves continuing physical work of a significant nature. Notice 2025-42 provides a list of excusable disruptions, such as natural disasters and financing delays, which will not cause a facility to fail the continuous construction requirement.5 Finally, Notice 2025-42 provides a safe harbor under which a facility is deemed to have met the continuity requirement if it is placed into service before the end of the fourth calendar year following the calendar year in which construction begins (although excusable disruptions are not available to extend the four-year period for this safe harbor). However, if the BOC Date for a wind or solar facility is after July 4, 2026, the OBBBA’s requirement that the facility be placed in service by December 31, 2027 in order to receive a tax credit supersedes the four-year period under the continuity safe harbor, since the facility would have to be placed into service by December 31, 2027 in order to qualify for the applicable tax credit.

Solely for purposes of determining whether construction of an applicable wind or solar facility has begun for purposes of Notice 2025-42, Notice 2025-42 includes a “single project” rule, which may aggregate multiple facilities for the purposes of determining the BOC Date of each facility. Under this rule, all relevant facts and circumstances must be considered in order to determine whether the multiple facilities are operated as a single project. Notice 2025-42 provides the following non-exclusive list of factors that should be considered for this purpose:

- The facilities are owned by a single legal entity;

- The facilities are constructed on contiguous pieces of land;

-

The facilities are described in a common power purchase agreement or agreements;

-

The facilities have a common intertie;

-

The facilities share a common substation;

-

The facilities are described in one or more common environmental or other regulatory permits;

-

The facilities were constructed pursuant to a single master construction contract; and

-

The construction of the facilities was financed pursuant to the same loan agreement.6

5% Safe Harbor for Low Output Solar Facilities

Notice 2025-42 provides that both the Physical Work Test, as described in Notice 2025-42, and the 5% Safe Harbor, as described in Notice 2013-29 (which is one of the BOC Notices), are available for a Low Output Solar Facility. This version of the 5% Safe Harbor is similar to the 5% Safe Harbor as described above.

Conclusion

The OBBBA and Notice 2025-42 impose strict restrictions on the availability of applicable wind and solar facilities to qualify for the clean electricity production and investment tax credits under Sections 45Y and 48E. The severity of these restrictions is based on a facility’s BOC Date. The following chart summarizes the timing considerations applicable to a facility’s BOC Date for the purposes of the OBBBA and Notice 2025-42:

-

Executive Order 14315, Ending Market Distorting Subsidies for Unreliable, Foreign-Controlled Energy Sources (July 7, 2025).

-

The beginning of construction determination for the purposes of the effective date is based on Notice 2022-61 (which is one of the BOC Notices, defined below). Section 5 of Notice 2022-61 provides that to determine when construction begins for purposes of Sections 45Y and 48E of the Code, principles similar to those under Notice 2013-29 regarding the Physical Work Test and 5% Safe Harbor apply, and taxpayers satisfying either test will be considered to have begun construction for the applicable facilites. In addition, principles similar to those provided in the BOC Notices regarding the Continuity Requirement for purposes of Sections 45Y and 48E apply. Whether a taxpayer meets the Continuity Requirement under either test is determined by the relevant facts and circumstances. Similar principles to those under Section 3 of Notice 2016-31 regarding the Continuity Safe Harbor also apply for purposes of Sections 45Y and 48E. Taxpayers may rely on the Continuity Safe Harbor provided the facility is placed in service no more than four calendar years after the calendar year during which construction began.

-

The BOC Notices include, among others, Notice 2022-61, Notice 2018-59, Notice 2016-31, and Notice 2013-21. See footnotes 4, 5 and 6 of Notice 2022-61.

-

Physical work of a significant nature does not include preliminary activities, even if the cost of those preliminary activities is properly included in the depreciable basis of the applicable wind or solar facility. Generally, preliminary activities for applicable wind or solar facilities include, but are not limited to: (a) planning or designing; (b) securing financing; (c) exploring; (d) researching; (e) conducting mapping and modeling to assess a resource; (f) obtaining permits and licenses; (g) conducting geophysical, gravity, magnetic, seismic and resistivity surveys; (h) conducting environmental and engineering studies; (i) clearing a site; (j) conducting test drilling to determine soil condition (including to test the strength of a foundation); (k) excavating to change the contour of the land (as distinguished from excavation for a foundation); and (l) removing existing foundations, turbines, and towers, solar panels, or any components that will no longer be part of the applicable wind or solar facility (including those on or attached to building structures).

-

Notice 2025-42 provides the following non-exclusive list of construction disruptions that will excuse a taxpayer’s failure to satisfy the continuous construction or continuous effort requirements: (a) delays due to severe weather conditions; (b) delays due to natural disasters; (c) delays in obtaining permits or licenses from federal, state, local, or Indian tribal governments, including, but not limited to, delays in obtaining permits or licenses from the Federal Energy Regulatory Commission (FERC), the Environmental Protection Agency (EPA), the Bureau of Land Management (BLM), and the Federal Aviation Agency (FAA); (d) delays at the written request of a federal, state, local, or Indian tribal government regarding matters of public safety, security, or similar concerns; (e) interconnection-related delays, such as those relating to the completion of construction on a new transmission or distribution line or necessary transmission or distribution upgrades to resolve grid congestion issues that may be associated with an applicable wind or solar facility’s planned interconnection; (f) delays in the manufacture of custom components; (g) delays due to labor stoppages; (h) delays due to the inability to obtain specialized equipment of limited availability; (i) delays due to the presence of endangered species; (j) financing delays; and (k) delays due to supply shortages.

-

Similar “single project” tests appear in the BOC Notices and elsewhere with slight variations. Unlike some of those tests, however, Notice 2025-42 does not set a minimum threshold of factors that must be present in order to find that multiple facilities constitute a single project.