Client Alert

On September 4, 2025, the Securities and Exchange Commission (the “Commission”) released its Spring 2025 Unified Agenda of Regulatory and Deregulatory Actions (the “2025 Agenda”), which outlines the Commission’s upcoming planned regulatory actions. Chairman Atkins announced the 2025 Agenda by stating: “it is a new day at the [Commission] focus[ed] on supporting innovation, capital formation, market efficiency, and investor protection.”

The 2025 Agenda

The 2025 Agenda is a significant departure from the Commission’s previous iteration and retains only 3 of the 31 items from the 2024 version. Commissioner Atkins noted that the 2025 Agenda reflects the SEC’s withdrawal of several items from the prior administration that “do not align with the goal that regulation should be smart, effective and appropriately tailored within the confines of our statutory authority.” Some noteworthy deletions include those relating to corporate board diversity, human capital management disclosure, disclosure of ESG investment practices, fund fee disclosure and reform, cybersecurity risk management and conflicts of interests associated with predictive data analytics, as well as amendments to the “accredited investor” definition, among others. While the 2025 Agenda provides insights into the relative priority and timing of rulemaking efforts, actual rule proposal timing may vary significantly.

The 2025 Agenda places a significant emphasis on crypto assets, with the potential rulemaking regarding to the offer and sale of crypto assets representing a significant new item on the 2025 Agenda. Other crypto-related innovations contemplated by the 2025 Agenda include amending rules to facilitate crypto trading as well as custody rules under the 1940 Act and Advisers Act, updating the rules for transfer agents, amending the broker-dealer financial responsibility and recordkeeping and reporting rules, and amending the Exchange Act to account for the trading of crypto assets on alternative trading systems, or ATSs, and national securities exchanges. These initiatives align with Commissioner Atkins’ goal of providing clearer rules relating to the issuance, custody and trading of crypto assets while still leaving room for rulemakings that almost certainly will be required by pending crypto market structure legislation such as the Digital Asset Market Clarity Act, also known as the CLARITY Act.

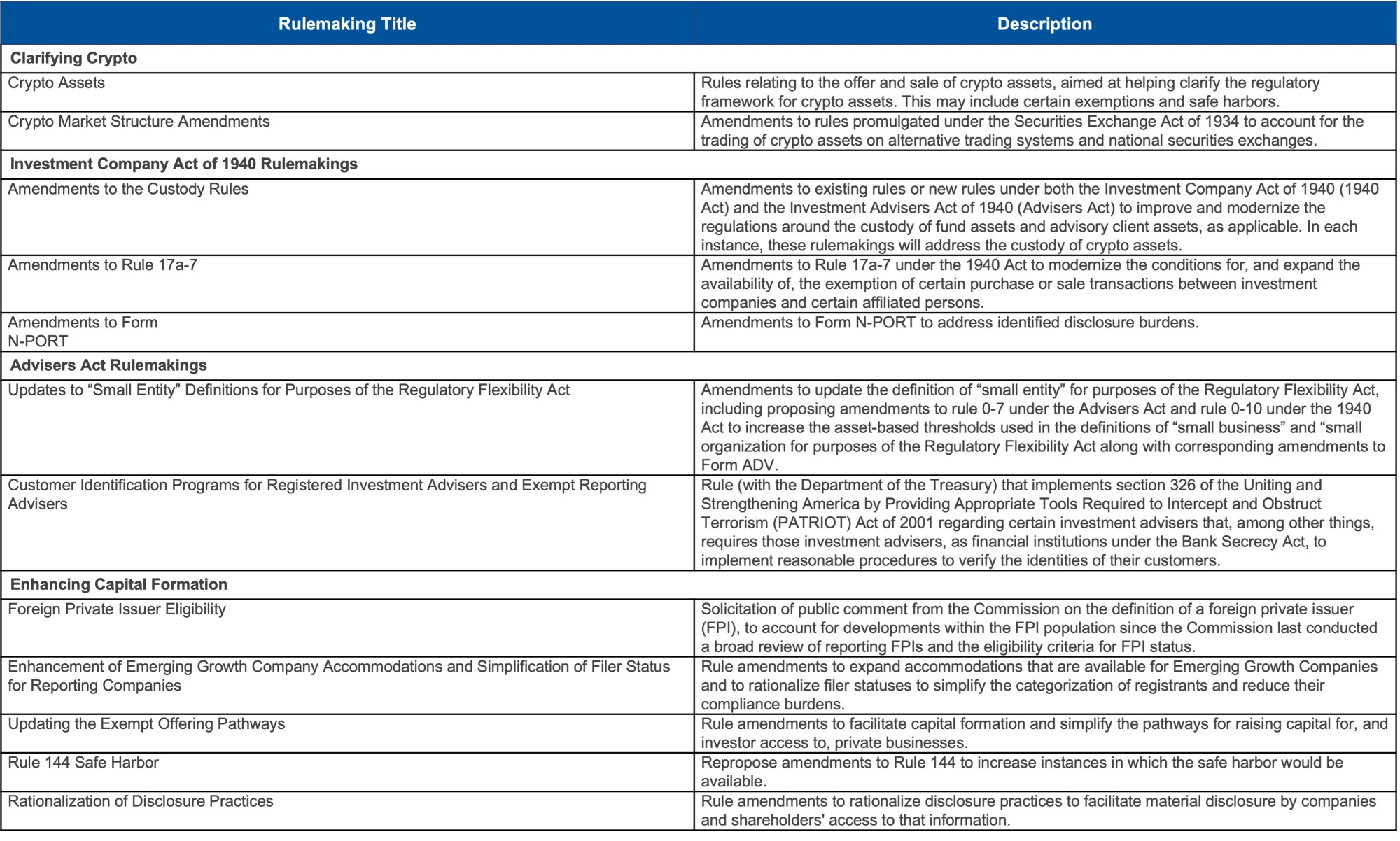

The full 2025 Agenda includes 23 separate items (the Commission’s complete 2025 Agenda is available here). The following table groups certain of those items in the 2025 Agenda by topic and provides additional information on the contours of rules to be proposed or finalized: